Omnichannel Banking Benefits, Challenges and Trends

- February 7, 2024

- 18 mins read

- Listen

Table of Content

The banking landscape is undergoing a revolutionary transformation where convenience is king, and time is of the essence. Omnichannel banking enchanting force reshaping the way we interact with our finances.

According to Capgemini, 76% of customers expect an omnichannel experience and 59% of customers expect on-demand, anywhere anytime customer service. It isn’t just about the convenience of mobile apps; it’s about creating a cohesive ecosystem where customers can automatically switch between various channels.

Are you ready to dive into the world where banking meets brilliance? Let’s navigate the landscape of omnichannel banking and discover the future of financial services together!

What is Omnichannel Banking?

Omnichannel banking is a comprehensive approach to providing automated and integrated banking services across multiple channels, both physical and digital. It aims to create a cohesive and consistent experience for customers. Resultantly, customer can interact with their bank effortlessly through various touchpoints such as online platforms, mobile apps, ATMs, call centers, and physical branches.

In an omnichannel banking environment, customers can initiate transactions from one channel to another without any disruption. For example, a customer might start a transaction on a mobile app, continue it on a computer, and finalize it in a physical branch. They can complete all without losing any information or experiencing inconsistencies in the process.

Moreover, it includes a unified customer profile that is accessible across channels, consistent branding, and messaging. The integration of technologies like data analytics and artificial intelligence (AI) to personalize and enhance the overall customer experience.

It is driven by the desire to meet the evolving expectations of modern customers who demand flexibility, convenience, and a personalized approach to their banking interactions. This approach not only benefits customers by providing an automated experience. Also, it helps banks to optimize their operations, improve customer satisfaction, and stay competitive in the rapidly evolving financial landscape.

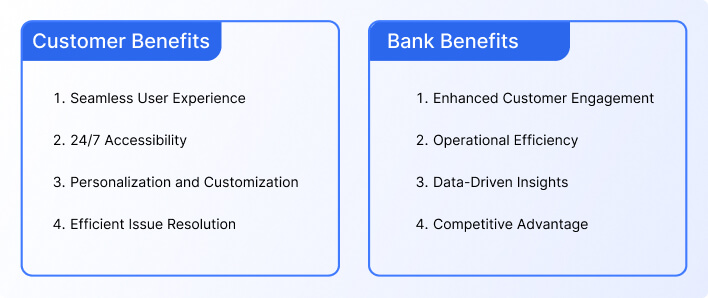

Benefits of Omnichannel Banking

In omnichannel banking, customers can interact with their bank across multiple channels such as mobile banking, online banking, ATMs, branches, and more. Here are some key benefits of omnichannel for banks and customers:

Customer Benefits

1. User Experience

When you switch from multichannel to omnichannel banking, you ensure a frictionless experience for customers by providing a consistent and unified journey across various channels. Whether accessing accounts through a mobile app, online platform, or visiting a physical branch, customers encounter a transition without disruptions.

This leads to increased customer satisfaction as users can effortlessly navigate and complete transactions.

2. 24/7 Accessibility

Customers gain round-the-clock access to banking services. Whether checking account balances, transferring funds, or making payments. Most importantly, users can perform transactions at any time through online platforms or mobile apps.

This enhanced accessibility caters to the modern lifestyle. It offers convenience and flexibility to customers who may not adhere to traditional banking hours.

3. Personalization and Customization

Omnichannel financial services uses data analytics to understand customer preferences, behaviors, and needs. This enables banks to provide personalized services and offers tailored to individual users.

It can personalize product recommendations to targeted promotional messages and customers experience a banking environment that caters specifically to their financial goals and interests.

4. Efficient Issue Resolution

In an omnichannel setup, customer issues, and inquiries can be efficiently addressed across various touchpoints. Whether through online chat, phone support, or in-person at a branch, banks can access customer information to resolve issues promptly.

This efficiency in issue resolution contributes to a positive customer experience and fosters trust in the bank’s service capabilities.

Bank Benefits

1. Enhanced Customer Engagement

Omnichannel banking enhances customer engagement by facilitating interactions through multiple channels. Banks can engage customers through personalized communications, targeted marketing campaigns, and feedback collection.

The ability to connect with customers across various touchpoints strengthens the overall relationship and encourages customers to explore additional services.

2. Operational Efficiency

Banks can achieve operational efficiency by integrating systems and processes across different channels. Reducing redundancies and streamlining workflows contribute to a more cost-effective and resource-efficient operation.

This allows banks to allocate resources strategically. Ultimately, it improves the bottom line and ensures a sustainable and competitive business model.

3. Data-Driven Insights

This platform plays an imperative role in generating valuable data on customer behavior, preferences, and transaction patterns. Analyzing this data provides banks with actionable insights into market trends, customer needs, and areas for improvement.

This data-driven decision-making empowers banks to optimize their services, design targeted marketing strategies, and stay ahead in a dynamic financial landscape.

4. Competitive Advantage

Adopting an omnichannel approach gives banks a competitive edge in the market. As customers increasingly seek personalized experiences, banks can deliver on these expectations stand out.

A comprehensive omnichannel strategy positions a bank as innovative and customer-centric to attract new customers and retain existing ones in a highly competitive industry.

Importance of Omnichannel in Retail Banking

Retail banks always need to stay relevant, competitive, and responsive to the evolving expectations of today’s digital-savvy consumers. Let’s take a look at some key reasons:

1. Enhanced Customer Experience

In retail banking, delivering an enhanced customer experience is paramount. Omnichannel financial services ensure that customers enjoy an automate and consistent journey across various touchpoints. Whether accessing services through online platforms, or in-person at branches.

This unified experience contributes to higher customer satisfaction as users can effortlessly navigate through channels without encountering disruptions or inconsistencies.

It goes beyond mere transactions and aims to create a positive and memorable interaction at every stage of the customer’s journey.

2. Improved Customer Engagement

The omnichannel banking platform provides multiple avenues for interaction. Retail banks can connect with customers through personalized communications, targeted marketing, and feedback mechanisms. The omnichannel approach enables banks to build stronger relationships with their customers.

This heightened engagement translates to increased customer loyalty, as individuals feel more connected to the bank and are more likely to explore additional services.

3. Efficient Operational Processes

It is needless to say operational efficiency is a key advantage of adopting omnichannel strategies in retail banking. Banks can reduce redundancies and streamline workflows by integrating systems and processes across different channels.

This optimization leads to a more cost-effective and resource-efficient operation for strategic allocation of resources. And, efficient processes contribute to quicker service delivery, faster issue resolution, and an overall improvement in the bank’s ability to meet customer needs promptly.

4. Competitive Edge in the Market

In fiercely competitive retail banking, having a comprehensive omnichannel strategy provides a distinct competitive edge. Customers increasingly seek personalized experiences, and banks that deliver on these expectations stand out in the market.

A retail bank with an effective omnichannel approach is perceived as innovative, customer-centric, and forward-thinking. This competitive advantage not only attracts new customers. Also, it enhances the retention of existing ones to reinforce the bank’s position in the dynamic and evolving market.

Multichannel Vs Omnichannel Banking

Multichannel and omnichannel banking represent two distinct approaches to providing banking services across various channels.

Let’s take a closer look at the key differences between these two strategies:

Multichannel Banking

- Channel Isolation: Each channel operates independently. Online banking, mobile apps, and physical branches often function as separate entities, with limited integration.

- Siloed Customer Experience: Customers may experience inconsistencies when transitioning between channels. Information is not always shared which is leading to a fragmented and siloed customer experience.

- Limited Cross-Channel Interaction: Customers may need to restart transactions when switching from one channel to another. For some customers it causes inconvenience.

- Channel-Specific Focus: Each channel is designed to cater to a specific set of services. For instance, online platforms may focus on transactions, while physical branches handle complex services.

- Operational Independence: Operational processes for each channel are often independent. This can result in redundancies and inefficiencies, as information is not consistently shared across channels.

Omnichannel Banking

- Unified Customer Experience: Customers can transit between channels without disruptions, as information is shared consistently.

- Consistent Branding and Messaging: Branding, messaging, and services are consistent across various channels. This creates a cohesive brand identity and reinforces the same level of service, regardless of the chosen channel.

- Cross-Channel Integration: Omnichannel banking emphasizes the integration of channels for a continuous and interconnected customer journey. Transactions can be initiated in one channel and completed in another without starting over.

- Holistic Customer View: This enables banks to offer personalized services and targeted marketing across all channels.

- Operational Harmony: Omnichannel banking platform allows for smoother workflows and optimized resource utilization by eliminating silos and redundancies.

How to Select an Omnichannel Banking Solution?

Choosing the right omnichannel banking solution is a critical decision for financial institutions, as it can significantly impact customer experience, operational efficiency, and overall business success.

Here are some key steps to consider when choosing an omnichannel banking solution:

1. Omnichannel Customer Experience Evaluation

Before selecting a solution, conduct a thorough evaluation of the omnichannel customer experience it promises to deliver. Assess how well the solution integrates and streamlines customer interactions across various channels such as online platforms, mobile apps, and physical branches.

You should always look for features that ensure transition between channels, consistent branding, and personalized experiences for customers. An effective solution should prioritize enhancing the overall journey of the end-users.

2. Banking Technology Landscape Exploration

It is imperative to explore the banking technology landscape to understand the compatibility and alignment of omnichannel financial services with industry trends and emerging technologies.

When you’re planning to select an omnichannel solution you need to ensure that the solution is built on robust and scalable technology. And. it is capable of accommodating future innovations. You can examine how the solution adapts to changes in technology, security standards, and regulatory requirements for long-term success.

3. Risk Tolerance and Cost Framework Establishment

Define your organization’s risk tolerance and establish a transparent cost framework before selecting an omnichannel banking solution. Also, consider potential risks associated with implementation, such as disruptions in services or data security concerns.

Assess the total cost of ownership, including initial setup costs, ongoing maintenance expenses, and any hidden fees. Align the solution’s features and pricing structure with your risk appetite and budget constraints to ensure a financially viable and secure investment.

4. Potential Suppliers and Service Providers Assessment

Evaluate potential suppliers and service providers offering the banking solution. Consider factors such as vendor reputation, reliability, and scalability. Assess their track record in delivering similar solutions and their ability to provide ongoing support and updates.

Look for references and case studies to validate their success stories. This comprehensive assessment helps in selecting a vendor that aligns with your organization’s goals and values.

5. Strategic Planning for Effective Implementation

Plan strategically for the effective implementation of the chosen omnichannel banking platform. Outline a detailed implementation roadmap that covers key aspects like user training, change management, and contingency planning.

Consider how the solution integrates with your existing systems and processes, minimizing disruptions during the transition. Define clear milestones, allocate resources effectively, and establish a communication plan to keep all stakeholders informed throughout the implementation process.

Challenges of Omnichannel Banking

While omnichannel banking offers numerous benefits, it also comes with its fair share of challenges. Some of the key challenges include:

1. Integration Complexity

Integration across various channels, such as online banking, mobile apps, and physical branches, poses a significant challenge. Connecting diverse systems and ensuring a unified customer experience can be complex and resource-intensive.

2. Data Security Concerns

It involves the exchange of sensitive customer data across multiple platforms. Ensuring robust security measures to protect against cyber threats and unauthorized access becomes a critical challenge in maintaining trust and compliance.

3. Consistent User Experience

Providing a consistent and cohesive user experience across different channels is a challenge. Users expect a unified journey, and discrepancies in service, features, or interface design can lead to frustration and dissatisfaction.

4. Regulatory Compliance

The banking industry is heavily regulated, and ensuring compliance with various financial regulations across different channels can be demanding. Staying abreast of evolving regulatory requirements and adapting omnichannel strategies accordingly is an ongoing challenge.

5. Technology Adoption Hurdles

The rapid evolution of technology introduces challenges related to the adoption and adaptation of new tools and platforms. Banks must invest in cutting-edge technologies while ensuring that staff and customers can embrace and utilize these advancements.

How to Achieve Omnichannel Banking Successfully?

If you want to achieve success, you require a series of essential steps. You need to focus on different aspects of the banking experience. Here’s a detailed guide to help you get there:

1. Define Your Omnichannel Strategy

You can start by outlining what you want to accomplish with omnichannel banking. With it, you can get enhanced customer satisfaction, better operational efficiency, or reach new markets. So, you will have to examine all customer touchpoints and interactions to ensure a smooth experience across channels. Your omnichannel strategy should align with your bank’s overall goals and vision.

2. Focus on the Customer

In this stage, you’ll have to gather insights through surveys, focus groups, and feedback to understand customer needs and expectations. You can use this data to provide personalized services and products. This will play a crucial role in boosting the overall customer experience. You must design your services emphasizing ease of use, convenience, and customer happiness.

3. Data Analytics and Insights

If you want to succeed in omnichannel banking, you must collect data from every customer interaction across various channels. Afterward, you can utilize analytics tools to gain insights into customer behaviors, preferences, and trends. Plus, use these insights to make well-informed decisions, tailor services, and predict future needs accurately.

4. Engage in Omnichannel Marketing

It is quite important. You need to maintain consistency in your marketing messages across all channels. So, how to do that? You can develop campaigns that utilize multiple channels to reach customers wherever they are. You can use these data for targeted marketing based on individual preferences and behaviors.

5. Provide Omnichannel Customer Support

Undoubtedly, customer support is key to achieving omnichannel banking. You must implement a support system that offers consistent service across online platforms, phone lines, or physical branches. Always place it a high priority to provide robust self-service options via mobile apps, websites, and ATMs. Also, ensure round-the-clock support availability on different channels.

6. Integrate Technology Infrastructure

In this phase, you need to adopt a centralized database to maintain data consistency and accessibility across all channels. You can integrate APIs for various systems and platforms. It will ensure a smooth service delivery. And yes, you should consider cloud-based solutions for greater scalability and flexibility.

7. Enhance Security Measures

Data security is vital in banking. You must protect all customer data with encryption both during transmission and storage. To achieve this, you can utilize multi-factor authentication (MFA) for an added layer of security during logins. Most importantly, don’t forget to conduct security audits and compliance checks regularly to identify and mitigate vulnerabilities.

8. Train and Engage Employees

Well-trained employees can be a game-changer. You must offer training programs for employees on omnichannel tools, technologies, and best practices in customer service. You should train employees in the omnichannel strategy. So, they understand its significance and their role in its success. You need to build a culture of continuous learning to keep pace with technological advances and evolving customer expectations.

9. Implement Scalable Systems

Choose modular system architecture for easy scaling and integration of new channels and services. In this case, you can invest in adaptable technologies that can adapt to future banking industry changes and growth. It is necessary to monitor system performance continuously to ensure smooth operations during peak times.

10. Transform Physical Branches

If you are managing routine transactions digitally, you need to shift the focus of physical branches towards advisory roles and complex services. To resolve it, you can equip branches to provide the same level of service as other channels. Essentially, it will ensure access to the same customer data and support tools. So, you will have to train branch staff to assist with digital channels effectively.

Staying on Top of Omnichannel Security

Security is one of the biggest concerns. How do to deal with it? What key measures need to be taken to stay safe and secure from any potential threats? Let’s take a look at some important aspects to stay on top of security.

1. Address Mobile Weaknesses

Fixing weaknesses in mobile banking should be the top priority. In omnichannel banking, mobile is a crucial channel for its massive use and constant connectivity, and it often faces risks. To protect against these threats, banks need to enforce strong encryption, multi-factor authentication, and consistent security updates. Most importantly, educating customers on how to safeguard their devices and identify phishing attempts is equally crucial for banks.

2. Secure Established Channels

Securing popular channels like online banking, ATMs, and call centers is just as important. These systems require robust security measures, such as end-to-end encryption, secure access controls, and continuous monitoring of suspicious activities. In doing so, banks can keep these channels and ensure overall security integrity.

3. Forecasting Future Trends

Being forward-thinking about future trends is essential to staying ahead of new threats. Banks should invest in cutting-edge threat detection technologies and artificial intelligence to foresee and counteract emerging security challenges. If the financial institution stays updated on the latest cybersecurity trends and incorporates proactive strategies into the security framework. It will enable banks to swiftly adapt to evolving dangers.

4. Engage With Customers

No doubt engaging with customers plays a key role in maintaining security. Banks should regularly communicate with customers about best security practices, updates, and potential risks. They can share valuable resources and support to help customers protect their personal information and report suspicious activities. Remember, building a culture of security awareness among customers can greatly reduce the likelihood of breaches.

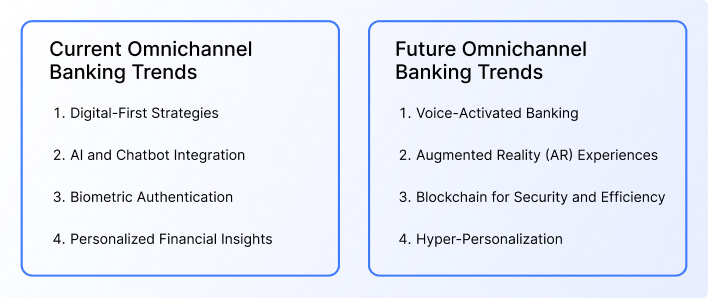

Present and Future Omnichannel Banking Trends

Omnichannel banking trends are driving innovation and transformation to enable banks to better meet the evolving needs and expectations of their customers in an increasingly digital and interconnected world. Let’s find some latest trends below.

Current Omnichannel Banking Trends

- Digital-First Strategies: Many banks are prioritizing digital channels, offering a smooth online experience and mobile banking applications to cater to the growing demand for convenient and accessible services.

- AI and Chatbot Integration: The integration of artificial intelligence (AI) and chatbots is becoming more prevalent, enhancing customer service by providing instant support, personalized recommendations, and efficient query resolution.

- Biometric Authentication: To bolster security and improve the user experience, biometric authentication methods, such as fingerprint recognition and facial scanning, are being increasingly implemented across various channels.

- Personalized Financial Insights: Banks leverage data analytics to provide customers with personalized financial insights, offering tailored advice, spending patterns analysis, and proactive financial management tools.

Future of Omnichannel Banking Trends

- Voice-Activated Banking: The rise of voice-activated devices is expected to lead to increased integration of voice commands for banking transactions, enabling customers to perform tasks using voice recognition technology.

- Augmented Reality (AR) Experiences: The adoption of augmented reality is anticipated to provide immersive and interactive banking experiences, such as virtual branch visits and enhanced product demonstrations.

- Blockchain for Security and Efficiency: Blockchain technology is expected to be further explored for its potential to enhance security, reduce fraud, and improve the efficiency of transactions across omnichannel platforms.

- Hyper-Personalization: The future of omnichannel banking involves hyper-personalization, where AI-driven algorithms provide highly individualized services, offers, and recommendations based on a customer’s behavior, preferences, and financial goals.

Conclusion

The choice of an omnichannel solution isn’t just a decision; it’s a commitment to revolutionize the way you engage with customers and navigate the technological frontier.

As you select the omnichannel banking solution that aligns with your vision, you’re not just adopting technology; you’re embracing a future where banking is not just a transaction. But, it’s a journey that’s automated, engaging, and thoroughly strategic.

You can start your journey and stay ahead of the competition with REVE Banking Chabot.

Frequently Asked Questions

1. Who Benefits from Omnichannel?

Businesses that aim to deliver a cohesive and integrated customer experience across various platforms, such as banks, retailers, and service providers.

2. What is an Omnichannel Example?

A bank allows customers to start a loan application online, continue it through a mobile app, and complete it at a branch without re-entering their details.

3. What Are Omnichannel Activities?

These activities include aligning marketing efforts across platforms, integrating customer service systems, and synchronizing inventory as well as sales data.

4. What is the Core Principle of Omnichannel?

The core principle of omnichannel is to ensure a unified and consistent customer journey across all touchpoints for automated transitions between channels.

5. What is the Purpose of Omnichannel?

Omnichannel aims to boost customer satisfaction, increase customer engagement, and boost operational efficiency by merging different communication and service channels.