5 Best Live Chat Software for the Banking Industry in 2025

- September 12, 2024

- 10 mins read

- Listen

Table of Content

When it comes to live chat software, there are countless options out there, each offering a variety of benefits. When you’re looking for the best live chat software for banking, many special considerations come into play.

It’s not just about offering quick responses—it’s about ensuring robust security, maintaining regulatory compliance, and providing a seamless, personalized experience that keeps customers coming back.

In banking, trust is everything, and the right live chat platform can make all the difference in building and maintaining that trust. Thus, in this article, we’ll explore 5 best live chat software specialized for your bank. So, let’s dive in.

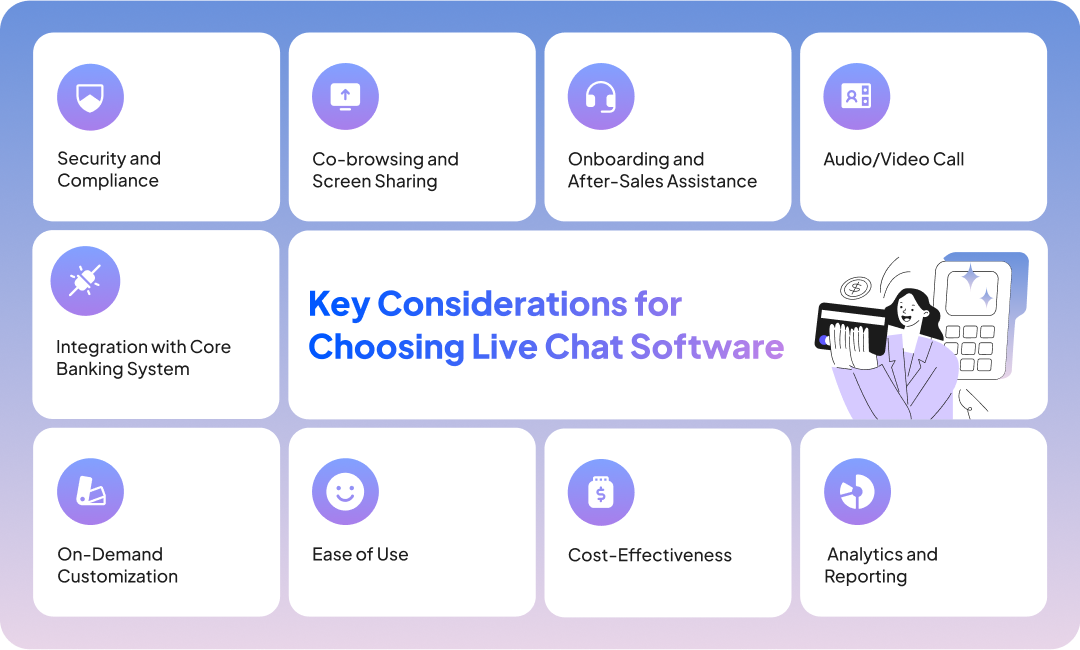

Key Factors to Choose a Live Chat Software for Banking

When choosing live chat software for banking, you must consider key factors that can make or break your customer service experience. Here are some essential things you should keep in mind:

1. Security and Compliance

In this modern era, protecting the data of your bank and your customers is paramount. Thus, when considering a software, you should look into the security features it offers.

These features should protect all of your customer’s data as your clients share a lot of confidential information over Live Chat. This should include features like end-to-end encryption, secure data storage, user authentication and more.

Additionally, your live chat software must comply with industry regulations like GDPR, PCI DSS, and other financial privacy laws. In totality, the software that you choose should have all the security features you need along with compliance with industry regulations.

2. Co-browsing and Screen Sharing

Co-browsing allows customer service agents to view and interact with a customer’s browser in real time. This personalized live chat feature plays a key role in providing direct guidance through complex banking tasks like online transactions, filling out any form, and loan applications.

This feature makes customer support hassle-free by reducing confusion. It offers a hands-on experience for faster resolution of customer queries, in particular, for users who need extra help navigating banking platforms.

Moreover, screen sharing allows agents to view a customer’s entire screen to assist with technical issues or step-by-step tasks, such as document submission or security setups. It helps agents quickly diagnose problems and guide customers more effectively. This feature makes interactions more efficient and transparent for troubleshooting or navigating detailed processes.

3. Onboarding and After-Sales Assistance

No matter how great the software is, issues can arise. This can happen when a bank starts using a new live chat software or at any point afterwards. This problem is twofold as you would need the live chat provider to have an efficient onboarding process as well as continuous support for the future.

It is an important aspect to look into as software malfunction on a regular basis and issues need to be addressed. Thus, banks have to check the whole scenario of whether the software is easy to start off with and whether there is continuous support for the app later on.

4. Audio/Video Call

Integrated audio and video calls provide a more personal touch to customer support. While live chat is great for quick interactions, audio/video calls are essential for addressing more complex or sensitive matters, like investment consultations or fraud alerts.

Video calls, in particular, build trust by offering face-to-face communication. It makes customers feel more connected and reassured during critical banking interactions. So, when it comes to choosing a live chat software for banks, you must focus on this service.

5. Integration with Core Banking Systems

Integrating a live chat software with your existing banking systems is another key consideration as it should easily integrate with your current banking systems—like CRM, payment gateways, and customer data platforms.

This ensures that your team has a 360-degree view of the customer and makes it easier to offer personalized support and fast resolutions. This is crucial for a bank as unifying all the systems via integration makes the management process much simpler.

6. On-Demand Customization

In some cases, your bank may require a more customized version of a live chat software. For that reason, banks need to scan the field as to which service provider will allow them to get a customized product. This customization can come in the form of a personalized UI, advanced unique features and more.

With more personalized requirements addressed, a bank can operate at a higher level than a regular live chat software would allow them.

7. Ease of Use

Your customers and support staff should find the live chat software user-friendly and easy to use. Undoubtedly, a complicated interface can slow things down and frustrate both sides.

So, you can select a platform with a clean, user-friendly design that makes it simple to start and manage conversations.

8. Cost-Effectiveness

Finally, it’s important to balance your budget with the features you need. Based on your budget for the tool you should find a solution that offers flexible pricing plans and matches your specific requirements.

Always remember that the right live chat software can bring you a strong return on investment by enhancing customer experience and boosting retention.

9. Analytics and Reporting

When it comes to live chat software for banking reporting is a powerful thing to consider. A good live chat solution will provide you with in-depth analytics and reporting tools.

You’ll want to track key performance metrics like response times, customer satisfaction rates, and chat volumes to continuously improve your service. These insights can help you refine your support strategy and better allocate resources.

5 Best Live Chat Software for Banking

|

Name |

Price |

Free Trial |

Best for |

|---|---|---|---|

|

$15/user/month |

✅ |

Live Chat Solution Tailored for BFSI Companies of Any Scale |

|

|

$29/user/month |

✅ |

SaaS & IT Service Companies |

|

|

$55/user/month |

✅ |

Advanced Ticketing System |

|

|

$14/user/month |

✅ |

CRM Capabilities |

|

|

$39/user/month |

✅ |

Small-Scale Customer Service Solution |

1. REVE Chat

REVE Chat is an all-in-one omnichannel live chat platform designed to elevate customer support and engagement. With a strong focus on live chat, REVE Chat helps businesses offer personalized, real-time customer service, particularly in the banking and finance sectors.

Tech-forward financial institutions like the Bank of Scotia, Commercial Bank of Kuwait, Southeast Bank, Veritas Finance, Kuwait Finance House, and bKash trust REVE Chat to enhance customer communication, increase online conversions, and deliver real-time assistance.

Our live chat platform, combined with co-browsing, video chat, and screen sharing, allows banks to assist customers in important processes like filling out loan applications, opening accounts, and more.

While REVE Chat includes an AI-powered chatbot to speed up responses, our priority is delivering personalized, and human-centric customer service in banking. The platform empowers businesses to offer high-quality, immediate support where it matters most.

Key Features

- Collaborative Support Tools: Advanced features like co-browsing, video chat, and screen sharing to assist customers directly in real time, improving issue resolution and enhancing customer experiences in banking.

- Omnichannel Engagement: Manage customer interactions seamlessly across multiple channels in a single, easy-to-use platform.

- Integration with Core Banking Systems: Seamlessly integrate your internal banking systems with our platform.

- Security and Privacy: We prioritize data privacy and security through SSL encryption and sensitive information masking to protect customer interactions, while ensuring compliance with industry standards.

- Customized Product: When required for a bank, we can customize our app for them based on demands and needs.

- Proactive Customer Interaction: Using features like auto triggers and proactive chat to engage customers at the right time.

- Smart Ticketing System: Convert customer chats into tickets for effective issue tracking and follow-up.

- Detailed Analytics and Reporting: Access insightful reports that allow businesses to monitor performance, track customer interactions, and make data-driven improvements to service quality.

- Mobile Support: REVE Chat’s mobile apps ensure that your team can offer customer service anytime, anywhere, maintaining flexibility and responsiveness.

With a comprehensive suite of features, REVE Chat is the ultimate platform for businesses looking to provide exceptional customer service while maintaining a strong focus on privacy and security.

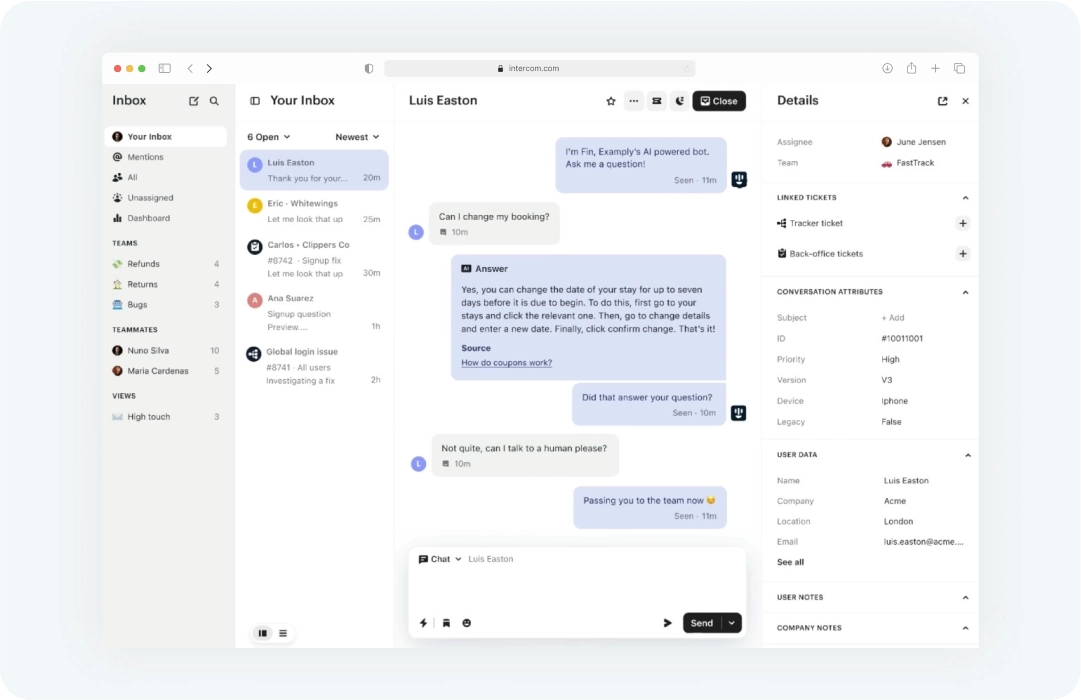

2. Intercom

Intercom is a popular live chat service for SaaS and IT companies. It offers the necessary tools for customer communication and engagement, designed to provide personalized customer support. Thus, Intercom is a solution that could serve banks in terms of customer support.

This platform supports live chat, messaging, and email to interact with customers through their preferred channels. Its analytics and reporting tools can help banks gain insights into customer behavior and improve service delivery.

Key Features

- Targeted communication and customer segmentation based on behavior and demographics.

- Customized bots that guide customers through specific processes, such as loan applications.

- Tracks customer interactions and agent performance to optimize service.

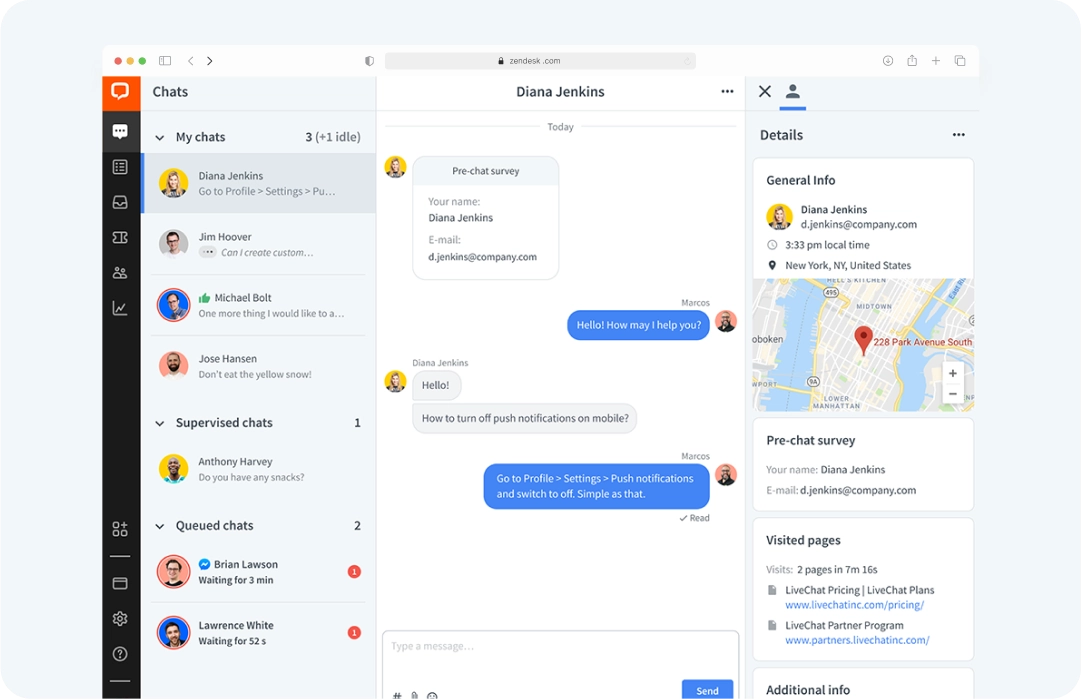

3. Zendesk Chat

Zendesk Chat is a well-established live chat solution that integrates hassle-free with their own customer service platform. Their key feature is an advanced ticketing system that allows businesses to address issues seamlessly.

Also, its ease of use and scalability can make it suitable for banks of all sizes. However, there are some limitations with Zendesk Chat. Integration with other platforms is not optimal for Zendesk Chat, which poses a problem for banks.

As such institutions require core system integrations, Zendesk Chat’s limitations could be an issue. Other than that, Zendesk can provide value for instant customer service.

Key Features

- Instant support to customers via a user-friendly chat interface.

- Automatically route chats to the most appropriate agents based on predefined rules.

- Set up triggers to send targeted messages based on customer behavior.

- Hassle-free integrates with other Zendesk tools

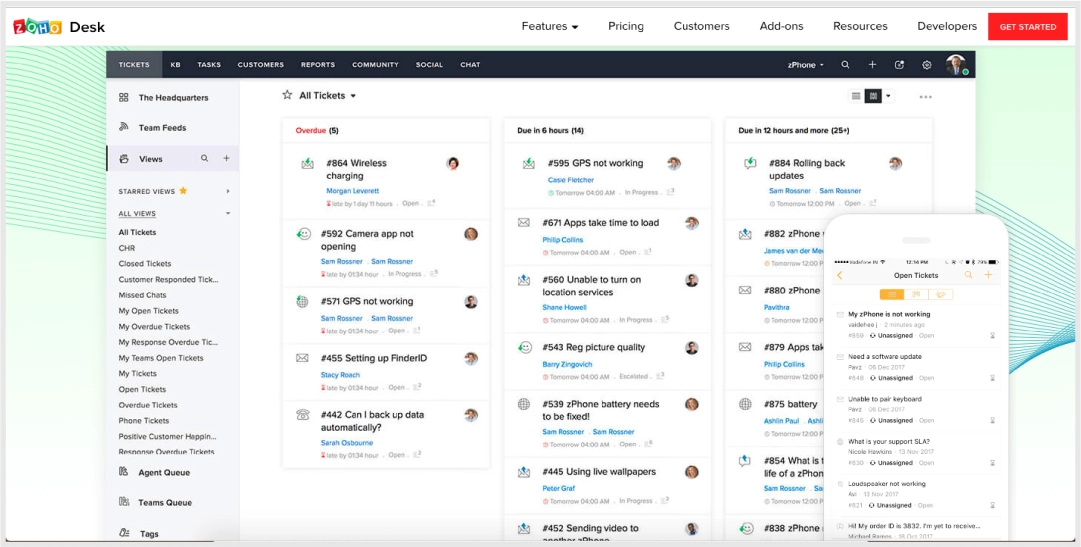

4. Zoho Desk

It is a cloud-based customer service platform that includes live chat as one of its core features. Primarily a CRM, Zoho Desk is designed to help customer support agents deliver hassle-free customer support by integrating live chat with other platforms.

Also, the platform’s ticketing system is particularly useful for tracking and managing customer inquiries. Zoho Desk works best with its own products as they seamlessly integrate to create a powerful solution for companies.

However, it is mainly a CRM that can only fill certain use cases for banks, as it is not optimized for such institutions. Still, banks may find value in utilizing Zoho Desk for its CRM and tracking system.

Key Features

- Integrates live chat with email, phone, and social media.

- Tracks and manages customer inquiries across all channels.

- Customizable dashboards for real-time monitoring of customer interactions.

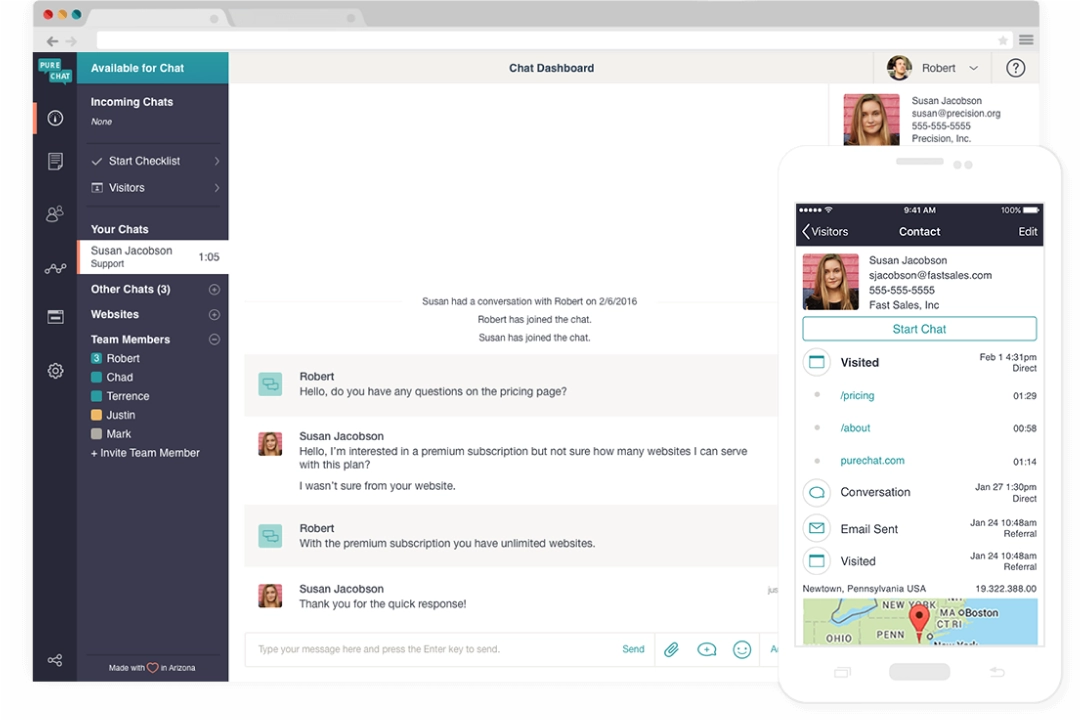

5. Pure Chat

Pure Chat is a straightforward and easy-to-use live chat software for small and medium-sized businesses. It offers an easy-to-use interface that makes it simple for customer service teams to engage with clients in real-time.

However, the software is fairly lightweight and does not have a lot of features. Also, given the scale of banks, they might find Pure Chat to be lacking in fulfilling certain uses that a financial institution needs.

Regardless, for a new and upcoming banking institution, Pure Chat can be a solution to start with for simple to use features at an affordable price.

Key Features

- Engage with customers instantly through a simple and intuitive chat interface.

- Monitors website visitors in real time and initiates chats based on their behavior.

- Pure Chat customizes chat widgets to align with your brand’s visual identity.

Conclusion

Banks face a lot of problems when it comes to customer service that a live chat software can solve. Hence, for a bank, a live chat solution is paramount.

Such a software can provide a personalized support to provide the best customer service possible across multiple platforms through omnichannel capabilities.

To achieve this goal, REVE Chat can be a powerful tool for your bank. We provide all the features through our app that will seamlessly integrate with your core banking systems and operate as efficiently as you would like it to be.

So, sign up now to experience what our platform has to offer for your bank.

Frequently Asked Questions

Live chat software enhances customer retention by providing quick and convenient support.

Besides, it addresses customer issues in real-time and offers personalized service, which helps build long-term relationships with clients.

Banks should implement encryption, secure authentication processes, data masking, and regular audits. It helps to ensure customer data remains protected during live chat interactions.

Yes, live chat software can be integrated with CRM systems, email platforms, and other customer service tools. It provides a hassle-free experience and a comprehensive view of customer interactions.

Live chat software can be integrated with other communication channels like social media, email, and phone support to engage customers across multiple platforms in a consistent manner.

It can guide new customers through the onboarding process, providing instant support and information. This helps reduce friction and improves the overall customer experience.

Live chat can handle peak times through automation features like chatbots, intelligent routing, and queue management. As a result, customers receive timely responses even during busy periods.

It provides real-time, personalized customer support, improving issue resolution and enhancing client engagement. It also helps ensure secure, efficient communication for handling inquiries, transactions, and financial advice.