Customer Lifetime Value: The Lifelong Worth of a Customer

- September 5, 2023

- 12 mins read

- Listen

Table of Content

Do you prefer engaging in transactions with clients who provide big amounts on rare occasions? Or do you lean towards those who consistently make smaller payments throughout the year? Indeed, there is a correct answer to this question, and trust me, it doesn’t rely on your instincts.

To respond like an expert, you should start by calculating the customer’s lifetime value. This metric helps identify the customers that contribute greater value to your company, ensuring its long-term viability. Sounds interesting? Keep reading this space to know more!

What is Customer Lifetime Value (CLV)

Customer Lifetime Value, known as CLV, pertains to the overall earnings a business generates from a single customer over the time span of their engagement with the company. This metric helps to understand customer behaviors, including their purchasing patterns and expenditures on the company’s offerings.

Customer lifetime value refers to the complete value a customer brings to a business throughout their entire interaction with the brand. Instead of focusing on single transaction values, this metric considers all possible transactions that could occur over the duration of the customer’s relationship with the brand, calculating the precise revenue generated from that customer. So, here to increase CLV, retaining your customers is very important.

Customer lifetime value can be approached from two angles: historical customer lifetime value (measuring the total amount each current customer has previously spent on your brand) and predictive customer lifetime value (estimating the potential amount that customers might spend on your brand). Both assessments of customer lifetime value offer valuable insights for gauging business achievements.

-

Historic Customer Lifetime Value

Let me give you one example here. if you’ve purchased a $50 Christmas tree from the same supplier for a decade, your historical customer lifetime value would be $500 – a clear calculation. This represents the historical aspect of customer lifetime value, which involves assessing past interactions. It’s valuable for grasping a customer’s past contributions to your brand and for shaping profiles of desired customers. However, when evaluated alone, it’s not as effective in forecasting future earnings.

-

Predictive Customer Lifetime Value

Another way to determine customer lifetime value is through predictive calculations. This involves utilizing historical data in an algorithmic manner to make informed estimations about the duration and worth of a customer relationship. Factors such as customer acquisition expenses, average purchase frequency, operational costs, and other variables are considered to provide a more accurate prediction of customer lifetime value. While this method can be more intricate, it offers insights into when to prioritize investments in customer loyalty.

How Can You Calculate CLV?

The process of calculating Customer Lifetime Value (CLV) involves four fundamental steps.

1. Calculate the Average Order Value of a Customer

Find out the typical sum that customers spend at your business. You can do this by examining data from your analytics tool or approximating it from recent customer transactions over the past months.

2. Determine How Often Transactions Occur

Next, ascertain the frequency at which customers visit your store. How frequently do they return within a defined timeframe? Is it on a weekly, monthly, or yearly basis?

3. Calculate the Extent of Customer Retention

Determine the typical duration of customer loyalty to your business. Specific sectors like restaurants and retail often exhibit a lower CLV due to customers gravitating towards better deals. While at the same time, industries like technology and travel boast a higher CLV as customers get enhanced product features and personalized vacation experiences.

4. Now It’s Time to Calculate the CLV

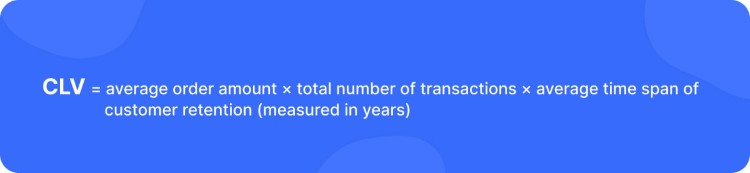

After gathering these details, compute CLV using the following formula:

With this data, let’s consider the example of a father who consistently buys smartphones for his family. His value could be estimated as:

$2,000 (per smartphone) × 2 (smartphones per year) × 10 (years) = $40,000

Hence, the Customer Lifetime Value amounts to $40,000.

The Hidden Power of Customer Lifetime Value: Why It Matters

The significance of Customer Lifetime Value lies in its ability to empower you with the potential of each customer throughout their purchasing journey. CLV enables you to enhance customer loyalty, minimize attrition, and make strategic business choices to cater to customer requirements.

For example, customer lifetime value can be employed to pinpoint customer groups that hold the highest value for the company, allowing for targeted approaches.

Below are additional reasons emphasizing the importance of comprehending your CLV.

-

Boosting CLV Can Gradually Increase Revenue

The greater a customer’s lifecycle or value within it, the higher the business revenue. Consequently, monitoring and enhancing CLV leads to increased revenue. CLV assists in pinpointing the customers who generate the most revenue for your business. This insight allows customization of offerings for high spenders, fostering their continued engagement.

-

It Helps Identify Issues and Improves Customer Retention

By placing emphasis on CLV within your business, you can uncover concerning patterns and develop strategies to tackle them. For instance, if you notice a consistently low CLV, you can enhance your customer support approach or refine your loyalty program to better cater to your customers’ needs.

-

It Assists in Pinpointing Your Target Audience

Understanding a customer’s lifetime value equates to knowing their expenditure within your business over a period, whether it’s $30, $300, or $3000.

With this insight, you can design a separate customer acquisition plan directed at those who are more likely to make substantial purchases at your business.

-

Enhancing CLV Can Lead to Lower Customer Acquisition Costs

The lifetime value and customer acquisition cost are really important here. Obtaining new customers often incurs significant expenses. According to a recent piece in The European Business Review, acquiring customers is usually five times costlier than retaining them. This underscores the importance of your business recognizing and fostering its most valuable customer relationships.

Putting Customer Lifetime Value into Action: Practical Strategies

Well, it’s time to relook the CLV formula.

If your aim is to enhance the CLV metric, you must either encourage customers to raise their shopping cart value, prompt them to shop more frequently or extend their duration of engagement with your brand. Alternatively, you could elevate all these aspects to make a significant impact.

The following suggestions are incredibly effective for enhancing customer lifetime value, whether you operate an e-commerce store, manage a brick-and-mortar shop, or are involved in the SaaS and subscription industry.

-

Enhance Your Subscription Structure

Consider Netflix or Spotify, for instance. They actively assess the value you bring as a customer and also divide their clientele into segments. This approach enables them to provide various subscription plans (such as family packages) or special deals and decide upon the duration of complimentary trial periods.

If your business operates within the realm of SaaS or subscription models, it’s crucial to prioritize the computation of customer lifetime value and the monitoring of retention rates. The initial stages of your customer relationship involve substantial investments (including acquisition expenses and possibly trial efforts). As a result, it’s only natural to seek a return on your investment, if not to at least reach a point of equilibrium.

-

Ensure Customer Satisfaction

Maintaining customer satisfaction is essential for prolonging client relationships. A study conducted by Microsoft on customer behavior revealed that 3 out of 5 Americans discontinued their association with a brand due to negative experiences. Such instances can significantly harm a brand’s reputation.

So, go beyond the basics to ensure customer satisfaction, particularly during the initial stages of your customer interaction. This embodies the fundamental tenet of relationship marketing. In order to enhance the customer experience with your brand (and enhance your Customer Lifetime Value metrics), it’s vital to guarantee the seamless operation of your website.

-

Deliver Exceptional Customer Assistance

Let me show you some stats here!

More than half of online users appreciate chatbots, mainly because they provide a way to reach out to businesses at any time. Chatbots are typically accessible to answer questions around the clock, even when businesses are not open.

Millennials favor live chat as their top choice for customer service compared to other communication channels.

According to Salesforce Research, when customer service is great, 89% of customers are likely to buy from you again.

So, as you can see your customer service should be accessible around the clock, coupled with a friendly and proactive approach. You might wonder, are these really important? The answer is a resounding yes.

Don’t worry! REVE Chat is here to help you out. It is an omni-channel customer engagement platform that lets you offer real-time help on your website, mobile apps and other social media platforms like Facebook, Instagram, Telegram, Viber and WhatsApp.

Your agents can be able to see users on your website in real time and can proactively reach them for assistance. Apart from that , REVE Chatbot is there to automate all your business operations and customer service facilities. This AI powered customer engagement platform offers 24/7 customer support even after your business hours and when all your agents are busy with some other tasks.

What to give it a try? SIGN UP today for the 14-day free trial!

-

Acknowledge and Encourage Customer Loyalty

An increasing amount of research demonstrates that rewards programs successfully enhance loyalty and retention. Make your loyal customers happy by providing discounts and benefits whenever they achieve specific milestones (like placing their first order or reaching a certain spending threshold).

Typically, as customers spend more, they receive better discounts in the future. Some brands also reward loyalty points for additional activities like writing reviews or following on social media.

During the pandemic, certain brands recognized the opportunity to provide their top customers with virtual experiences. These could be personalized consultations or podcasts.

-

Streamline Customer Onboarding Procedures

The onboarding phase presents a great chance to connect with new subscribers and enhance your customer lifetime value strategy. It’s vital to establish a robust customer engagement plan that seamlessly incorporates them into your business. Develop comprehensive step-by-step guides, informative tutorials, how-to videos, and other valuable content to ensure a smooth and stress-free onboarding process. Your responsibility lies in simplifying tasks to assist customers in reaching their objectives, thereby encouraging them to stay for an extended period.

For those operating within a subscription-based business, the primary responsibility is to minimize customer churn. Direct your efforts toward crafting a seamless onboarding procedure. It’s worth noting that a subpar onboarding experience contributes to a 23% attrition rate among existing customers who either cancel or choose not to renew their subscriptions.

-

Send Your Emails regularly

What’s the ideal number of monthly emails to send? Omnisend data suggests aiming for 10-19 emails per month, but this isn’t a fixed rule. Ultimately, you should determine a frequency that aligns with your customers and business. It’s wise to conduct tests on metrics like email open rates and click-through rates (CTRs).

Additionally, offering your customers a choice is a good approach (such as weekend newsletters only).

-

Upselling and Cross Selling

Selling to your current customers is simpler than acquiring new ones. By doing this, you significantly enhance the lifetime value of that customer. In the world of e-commerce, upselling is like hitting the accelerator. While you’ll reach your destination without upselling, you’ll get there much quicker by incorporating upselling strategies.

Upselling and cross-selling generate significantly higher profits than what you’d receive from typical customers. However, it’s important to note that upselling isn’t a random endeavor. Deliberate planning is required to offer valuable supplementary packages, enhancing the customer experience in the process.

Exploring CLTV in Action: 3 Compelling Case Studies

The Customer Lifetime Value (CLV) fluctuates according to the characteristics of the product or service. Let’s explore diverse industries to illustrate the potential impact of CLV on your overall profitability.

-

Local Market

Neighborhood stores build strong connections with local residents. Consider a scenario where a shopper regularly visits a grocery store every week, spending approximately $100 on each visit. Over the course of three years, if the customer maintains this weekly routine, the CLV will be:

-

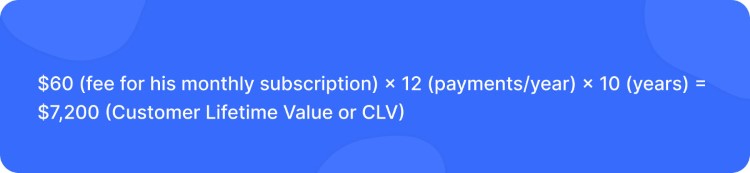

SaaS Subscription

An example of a UX designer subscribing to a cloud-based service to design mobile apps can help illustrate this. Let’s assume the designer pays $60 per month for 10 years for this essential software. As the subscription remains consistent due to its job-related significance, his CLV will be:

-

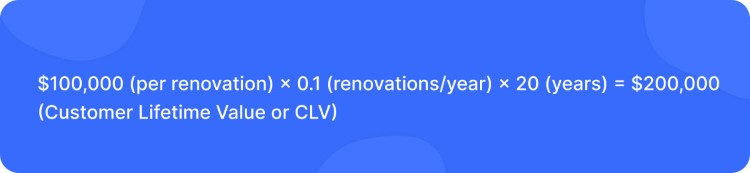

Home Decoration

Interior design firms often deal with higher costs. Imagine a scenario where a homeowner invests $100,000 in renovating their residence. Pleased with the initial outcome, they continue to engage the interior design agency for renovations every 10 years over a span of 20 years. So, here the calculation will be:

These instances highlight how lifetime customer value differs in various sectors. Everyday items like coffee witness frequent purchases, necessitating repeated transactions for a notable CLV. On the other hand, certain products like houses, cars, or interior design services boast lower buying frequencies. Yet, due to their unique nature, they accumulate substantial sums through just a handful of transactions.

Wrapping Up!

The Customer Lifetime Value (CLV) aids in estimating the long-term spending of customers on your business. This estimation serves as a foundation for understanding customer loyalty, guiding decisions related to acquisition, marketing, and sales strategies.

Transforming your small business into a flourishing empire is a desirable goal, yet challenges can emerge unexpectedly. Economic downturns or inflation, for instance, might lead to a decline in your Customer Lifetime Value (CLV). Additionally, adjusting product prices due to production costs and unpredictable market dynamics could become necessary. So, remain adaptable in the face of unforeseen circumstances and be open to modifying your CLV strategy in response to these trends.