Customer Acquisition In Banking: 6 Effective Strategies (2025)

- November 10, 2024

- 10 mins read

- Listen

Table of Content

Once upon a time, customer acquisition in banking was not a point of concern. Droves of people used to stand in line to get a spot at the counter or a seat at a desk to get financial advice or solutions. Now, FinTech companies have emerged and changed the landscape of the financial industry. Thus, banks are on a journey to create strategies for efficient and successful customer acquisitions through modern techniques and solutions.

This blog will go through how you can improve your customer acquisition strategy for your banks. But first, what is customer acquisition in banking?

What is Customer Acquisition in Banking?

Customer acquisition in banking is all about drawing in customers with alluring offers and excellent services to avail at your bank. That consists of the following key points:

- Creating strategies to entice potential customers through various platforms.

- Offering excellent services and tempting offers for current and future clients.

- Rewarding customer loyalty through referrals and/or reward systems.

- Building relations with your consumers through an extensive communication system.

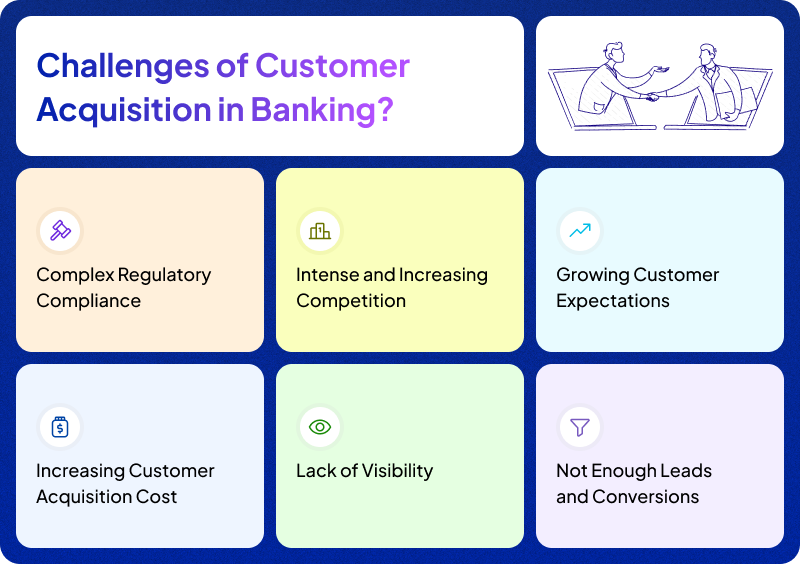

What are the Challenges of Customer Acquisition in Banking?

Customer acquisition for banks has become quite a task due to the digital era we live in. Traditional banking struggles to compete with the plethora of digital avenues financial institutions are making use of.

Thus, banks are striving to evolve and counteract all the challenges they are facing in terms of customer acquisition. There are many challenges to customer acquisition for banks, and here are some of the key ones:

- Complex Regulatory Compliance: When it comes to regulations, banks have to comply with a number of rules. The most common ones are data and financial protection rules like the GDPR and the anti-money laundering (AML) rule. This forces a bank’s hand and takes some resources away from investing in customer acquisition.

- Intense and Increasing Competition: In days past, banks had to compete with other banks. Now, it’s all sorts of financial institutions, whether it be FinTech companies or compatriots. Thus, it’s a tough market, and banks have to reinvent themselves in order to set themselves apart from the pack.

- Growing Customer Expectations: With so many options in the market, customers have higher needs and expectations from banks or financial institutions. Furthermore, their expectations are growing with every passing moment. That makes it harder to entice prospective customers to your bank as you have to keep up with these increasing demands.

- Increasing Customer Acquisition Cost: This is a key metric for gaining customers as it has become costlier to do such strategies. A report by Invespro shows how much customer acquisition costs have risen. Hence, banks have to invest more in order to gain more clients.

- Lack of Visibility: Similar to how the competition is increasing for your bank, it is also a huge problem when your bank is not at the forefront of people’s minds. Without proper visibility, there is less of a chance to get new customers, as not many people are looking at you as an option.

- Not Enough Leads and Conversions: This is related to the challenge above, as in many instances your bank is not generating enough leads or not converting enough of them. Also, there can also be issues regarding the leads not being viable enough from the start. This is an important aspect that needs to be fixed to improve customer acquisition.

Strategies to Use for Customer Acquisition in Banking

Many metrics, data, and such can be used to improve customer acquisition marketing for a bank. That leads to management of banks to create or experiment with all sorts of strategies to improve their customer acquisition numbers.

REVE Chat has a great track record on this front as we work with the Commercial Bank of Kuwait. Our products provide the services for customer engagement and support to help the bank be successful as a business. Our collaboration with the CBK shows how REVE Chat knows what it takes to be successful in the banking industry.

Thus, these are some strategies that you can use to improve your bank’s customer acquisition.

Omnichannel and Multichannel Marketing Strategy

For customer acquisition, the first and foremost thing you need to keep in mind is to be visible to potential customers and offer them a proper communication channel to converse or interact with you. That’s where both multichannel and omnichannel marketing come in.

While the focus of these two marketing strategies is different, they both lead to customer acquisition and retention at the end of the day. Both strategies provide different benefits and allow your customer acquisition strategy to take a different form when you are able to combine the two ideas in some capacity.

How does Multichannel Marketing help Customer Acquisition in Banks?

Multichannel marketing is all about investing in different communication platforms. Its purpose is to reach customers through both direct and indirect means of communication. Many aspects of multichannel marketing can be utilized for banking.

Thus, below are the key points of how multichannel marketing can help customer acquisition for banks

- Increasing the visibility of banks through blogs and social media

- Create a better communication infrastructure with customers

- Attracting customers via ads and campaigns.

- Dispersing information about your products and services.

For many of the points above, REVE Chat can provide you with a lot of benefits. Our product can integrate with many of the platforms that you will need for your bank. Whether it be live chat or chatbot for your communication infrastructure or visibility on social media, REVE Chat will be an excellent asset for you.

Omnichannel Marketing and Customer Acquisition in Banks

While multichannel marketing focuses on visibility and reaching customers using those platforms, omnichannel marketing is all bout integrating and combining those platforms under one umbrella. While the former enables customer attraction, omnichannel marketing empowers customer service.

Hence, this is how omnichannel marketing can improve your bank.

- Use of live chat and chatbots for consistent and quick customer support

- All interactions in different platforms converge under one big umbrella

- Personalized communications

- Data and feedback gathering for future optimizations

Using REVE Chat’s products can help you with omnichannel marketing, as it is one of our specialties. We have excellent API integrations with helpful guides on how to do it. Also, our no-code-required chatbots integrated with live chat can take your customer support system to the next level by providing quick replies and personalized messaging for your customer’s needs.

Augmenting Customer Experiences

Customer satisfaction is one of the key aspects that a bank has to keep in mind. Providing great service to customers helps improve customer experience as well as other benefits in the long run. Hence, augmenting customer experience is important for customer acquisition, and here is how you can do that.

Understanding What Customers Want

Understanding what your customer wants is extremely important as then you can provide them with personalized offerings, promotions, and services. That immensely improves customer experience as now you are tailoring your offerings for them.

Improving the Onboarding Experience

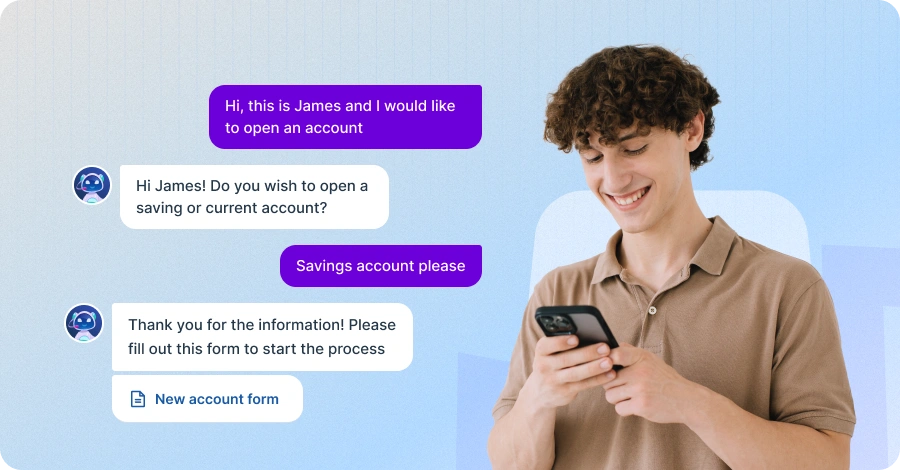

Starting to work with a bank is a hassle. Hence, the use of an automated system can really help with the onboarding experience. Thus, using a chatbot or live chat to gather all the information necessary and make the process more convenient is good for the customers and for you.

Improving Customer Support

It is also important to ensure that your customer support is top-notch and answers all the queries quickly and efficiently. This is where REVE Chat’s products can really help as we are experts in the field of customer support.

Referral and Reward Programs

Offering reward programs improves customer experience a lot as consumers feel rewarded for working with you. Also, that converts them into happy customers, who will refer you to another person. So, utilizing both referral and reward programs incentivizes your current user base to contribute to customer acquisition in a significant way.

Customer-Centric Innovations

In order to improve customer experience and take your bank to further prominence, you need to adapt and innovate. Staying up-to-date with the latest technology and regulations is an important part of this process. There are several innovations that your bank has done or needs to do for the modern age.

Online and Mobile Banking

These days, customers like to access their financial services on the go. Facilitating such a system will help improve customer engagement and experience. Also, it makes banks very versatile in terms of providing customer service.

Use of AI-Chatbots and Live Chat

While live chat has been around for a while, the new AI-powered products have taken this a step further. This helps banks all around the world to offer proper service to customers. Our live chat and AI-powered chatbots offer the best solution for a bank in terms of automating queries, offering solutions, and the like.

Modernizing Website and Other Information-Related Platforms

In this day and age, it is important to have a fluid website and platforms that convey everything there is to know about your bank. Spreading the net wide and getting your information out there is a good way to let people know what you are all about.

Partnerships and Collaborations

While banks can potentially do all sorts of financial services, there is a limited number of resources available. So, a lot of the time, everyone cannot implement everything. Hence, partnerships and collaborations are nice when you can team up with another company or service to offer something new.

Whether it be some community outreach program, or customer service systems like reve chat, these are always helpful for banks to acquire customers.

Digital Marketing

In the modern era, it is important to have a presence digitally. Multichannel marketing is for this purpose but a more specific way to go about it is digital marketing. This can be achieved by doing the following process.

Paid searches

Running a paid search program means just using ads to attract customers to your services and platforms. This can be in the form of PPC campaigns, sponsored paid results to search engines, or image-based ads. This strategy can generate quite a number of leads that can turn into customers.

Affiliate Marketing

Employing partners and platforms to promote your service and products is another way to go about it. Whether it be on the news or on a podcast, this can generate a lot of leads as recommendations from influencers or platforms users trust can go a long way.

Social Media Promotion

Posting about your services and products on social media platforms will increase visibility and allow potential customers to know about your services. That can generate leads through customers visiting your website and contacting you for your services.

Final thoughts

That said, banks are having to adapt to a new era. Methodologies have changed, and customer needs have evolved. Thus, new challenges have emerged, and innovations are required.

As a result, banks are using new strategies for customer acquisition, and many of the common ones are listed and explained above. It’s all about the customers and how you can take your institution to the next level and serve your clients well.

This is why REVE Chat exists: to act as a bridge between your bank and your customers. We provide solutions to you to improve customer experience, marketing, and more.

Thus, sign up and get access to top tools for customer engagement in banking, revolutionizing your offers for a new dawn.

Frequently Asked Questions

Customer acquisition in banking is all about drawing in customers with alluring offers and excellent services to avail at your bank.

Customer acquisition strategy is a plan of action to attract customers to your business. That requires a thought-out system backed by data.

It allows businesses to sustainably grow sustainably in terms of sales, revenue, brand awareness, and build customer loyalty. Also, having a good strategy makes marketing much more efficient while creating a proper foundation to grow as a company.

By using different strategies like Multichannel and Omnichannel marketing, improving customer support using live chat and chatbots, implementing online and mobile banking, and more innovations for customers. That way you can send your message to a wider audience and have systems in place to serve the customers well.

Live Chat and Chatbots can make customer support easy to handle while also making the onboarding and information collecting process easy. Furthermore, you can gather customer feedback this way and use all the data acquired to innovate for the future.