Decoding Customer Acquisition Cost vs. Lifetime Value

- July 18, 2023

- 14 mins read

- Listen

Table of Content

As an entrepreneur, the ability to effectively market and sell your product or service is paramount. Without the ability to generate sales, your business cannot thrive; it is essential to find ways to monetize what you offer. Understanding the concept of customer acquisition cost vs lifetime value is really important here.

Have you ever taken a moment to analyze the true cost of acquiring a customer for your business? I’m not just referring to generating leads, but rather the entire sales process leading up to a person actually making a purchase. I encourage you to engage in this exercise; I assure you; it will bring about a profound realization. The process of acquiring customers and enticing them to make their initial purchase is a costly endeavor.

Once you have determined the cost of acquiring a customer for your business, take a moment to contemplate the following question: How much value will that customer bring to your business over their entire lifetime? I pose this question because, all too frequently, business owners overlook the significance of long-term relationships and focus solely on immediate gains. Acquiring a customer becomes futile if you are not willing to invest the effort required to retain them.

In the realm of online business, there are two pivotal metrics that hold immense significance in addressing these inquiries: Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV). These two profoundly contribute to your ability to analyze and enhance the prosperity of your business.

Within this article, we will delve into the fundamental aspects of both CAC and CLV and shed light on their significance to online merchants. Also, will examine how the CLV to CAC ratio can be optimized to help merchants thrive in competitive markets and achieve success.

So, let’s start!

What is Customer Acquisition Cost (CAC)

The customer acquisition cost represents the overall expenditure involved in acquiring a new customer. It encompasses expenses such as sales team costs, advertising expenditures, marketing expenses, and any other outlays associated with bringing your product to the customer. It includes the following:

- Physical signage and billboards

- Online promotional activities

- Radio advertisements

- Telephone solicitation

- Social media marketing campaigns

- Salaries of marketing personnel

- Costs related to advertisement design and development

- Additional expenses linked to these activities

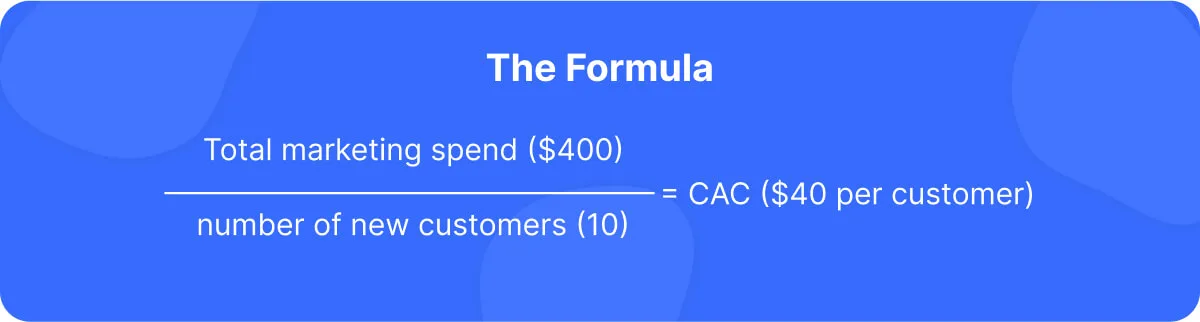

How to Calculate CAC

Marketing for a small business can often be likened to a trial-and-error process. Assessing the impact of your marketing endeavors is crucial for cost management and allocating resources toward successful channels and campaigns.

Companies frequently compute the customer acquisition cost (CAC) by summing up all advertising expenses and subsequently dividing the total by the number of newly acquired customers.

Consider this scenario: A business invests $400 in Google Ads, which successfully yields 10 customers. In this case, the average customer acquisition cost can be determined as $40 per customer.

What is Customer Lifetime Value (LTV)

Customer lifetime value (CLV) or lifetime value (LTV) is a quantitative assessment that estimates the potential earnings a business can anticipate from a particular customer throughout their relationship, taking into account costs and expenses incurred along the way.

It takes into consideration the revenue generated from the customer’s purchases, as well as any additional value they bring through referrals, repeat purchases, or upselling opportunities. CLV helps businesses understand the long-term profitability of acquiring and retaining customers, as well as enables them to make informed decisions regarding marketing strategies, customer retention initiatives, and overall business growth.

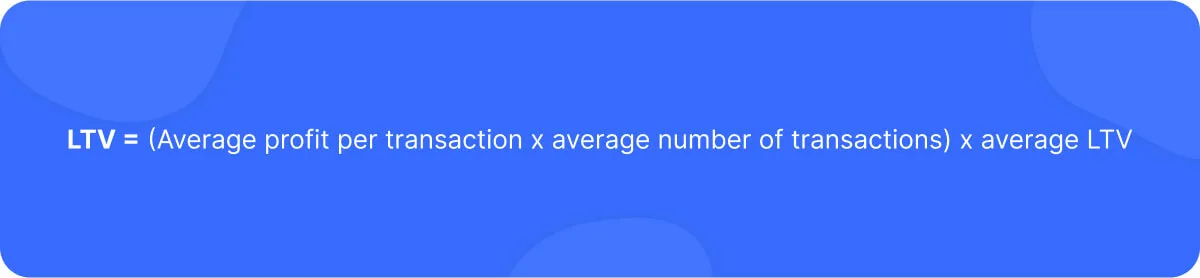

How to Calculate LTV

To determine the customer lifetime value (LTV), begin by computing the annual customer value. This involves averaging the revenue generated from each customer’s orders and subtracting expenses such as shipping fees, transaction costs, refunds, and taxes to determine the profit.

Next, multiply the profit by the average number of purchases made by the customer within a specific time period. Finally, multiply the result by the expected duration of the customer’s relationship with the business. This formula provides a reliable approach to calculating LTV and understanding the long-term value a customer can bring to the company.

The following formula can be utilized to calculate the customer lifetime value (LTV):

Customer Acquisition Cost Vs. Lifetime Value

CAC provides information about the expenses incurred by a company in acquiring customers who make purchases, while LTV offers insights into the potential profitability derived from a customer. Here are some additional noteworthy distinctions between customer acquisition cost and customer lifetime value:

Customer Lifetime Value Vs Customer Acquisition Cost

- CAC gauges the expenditures incurred by a company, while LTV quantifies the profitability it attains.

- Companies strive for a lower CAC and a higher LTV.

- CAC tends to provide a more concrete metric, whereas LTV typically involves an estimation.

By combining these two measures, you can gain insights into the relationship between their profits and expenses and identify new opportunities for enhanced efficiency. Here you can also integrate customer lifetime value and customer acquisition cost data to establish the ratio of LTV and CAC. This ratio aids in comprehending the operational costs and profit potential of the company in a more comprehensive manner.

Impact of Customer Lifetime Value (LTV) on CAC

Customer lifetime value (LTV) plays a crucial role in assessing the overall profitability as it quantifies the potential revenue that can be generated from a customer throughout the duration of the business relationship.

The lifetime value and customer acquisition cost ratio establishes the connection between CAC and customer lifetime value. This ratio holds significance in evaluating the profitability of your business. It enables you to determine whether the value derived from a customer exceeds, falls short of, or aligns with the cost incurred in acquiring that customer.

For ecommerce businesses, a desirable LTV:CAC ratio is approximately 3:1, indicating a healthy state. If the ratio falls below this threshold, it suggests a potential risk to the business. Conversely, a higher ratio indicates favorable conditions and may signify the readiness for business expansion. Therefore, when reevaluating your overall business and marketing strategies, this calculation becomes a valuable tool to consider.

How to calculate LTV to CAC ratio?

The LTV:CAC ratio, also known as the ratio of Customer Lifetime Value to Customer Acquisition Cost, serves as a tool for your company to assess the relationship between the costs of acquiring customers and the returns generated. Let me give you a detailed guide here outlining the process of calculating, interpreting, and comprehending this measure:

To ascertain the LTV to CAC ratio, start by calculating the LTV and CAC values. Then, divide the LTV value by the CAC value to determine the amount of revenue your company generates for every dollar invested in acquiring customers.

The Interpretation- LTV:CAC

When your company’s customer lifetime value vs customer acquisition cost (LTV:CAC ratio) is one or lower, it indicates that the company is generating less than one dollar in revenue for every dollar it spends on customer acquisition. In such cases, your company may be experiencing financial losses and should contemplate reducing expenses or enhancing customer retention strategies to improve its financial standing.

A ratio of three or greater is widely regarded by marketing professionals as an optimal benchmark. This signifies that the value derived from a company’s customers is three times higher than the cost invested in acquiring them. If a company’s ratio surpasses three, it suggests a high level of success. However, the company might contemplate allocating more resources to advertising in order to further stimulate its growth.

What is a Good LTV to CAC Ratio?

Picture your business as a seesaw: spending as much on marketing as you earn from each customer (1:1) might seem fair, but it’s a risky game.

The magic number is 3:1(lifetime value: customer acquisition cost) – where a customer’s value is three times more than what it costs to get them on board. This not only ensures profit but also covers extra startup expenses.

Having a higher customer acquisition cost and lifetime value ratio means more profit per customer, but it could mean missing out on new customers. Think of it like this: a better conversion rate gives you the green light to spend a bit more on getting new customers, keeping your business on the up and up.

So, make sure you’re getting the most from each customer while also bringing in new ones. This way, your business is set for steady and successful growth.

Driving Long-Term Value: 7 Approaches to Boost Your CLV to CAC Ratio

After calculating the LTV:CAC ratio for your company, your team can explore strategies to enhance profitability. This can be accomplished by both reducing costs and increasing profits. Lowering the Customer Acquisition Cost (CAC) will be helpful in reducing expenses. Simultaneously, improving the Customer Lifetime Value (LTV) can contribute to increased profits. Let me give you further insights into these customer lifetime value formula and acquisition cost methods:

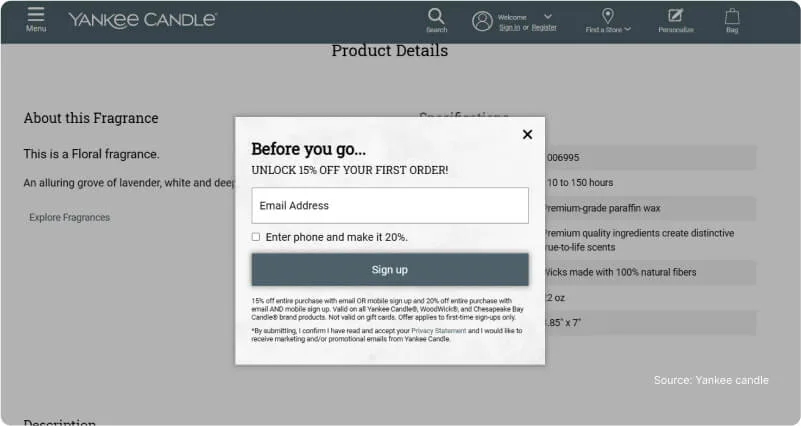

1. Incorporate a Subscription-Based Experience

In the conventional eCommerce business model, the lifetime value of a customer relies on their repeated decisions to purchase your product on a per-transaction basis. However, by implementing a subscription model, this process is automated, enhancing convenience for your customers while establishing a more dependable and predictable revenue stream for your business.

Here it is important for you to make customers understand the advantages of subscribing since it proves to be a more efficient method for increasing the lifetime value of customers.

Let me give you one example here.

Yankee Candle provides customers with the choice of purchasing eligible products either as one-time buys or opting for a subscription plan, which allows them to save money. Additionally, Yankee Candle simplifies the process of setting the frequency of candle deliveries, which serves as an extra incentive for customers to enroll in the subscription program.

2. Customer Loyalty Program

Implementing a loyalty program and incentives encourage your customers to remain loyal to your brand for an extended duration by providing incentives. These incentives can include rewards such as loyalty points, offers, discounts, or other exclusive benefits, which are granted for both initial and recurring purchases. By doing so, the loyalty program enhances your customer lifetime value (CLV) without necessitating an increase in customer acquisition costs (CAC).

Furthermore, loyalty programs have the added advantage of fostering a sense of goodwill among customers and reinforcing brand loyalty, as suggested by its name.

Here one example will be Starbucks. As its name implies, Starbucks Rewards operates on a rewards-based framework where you can accumulate stars with every purchase you make. The number of stars you earn varies depending on your chosen payment method. These stars can be later redeemed for a range of complimentary coffee and food offers, along with exclusive extras reserved for members, such as express order and pick-up services.

3. Prepaid Subscription

As customer acquisition costs (CAC) have shown fluctuations in recent years and inflation rates have risen, brands are actively seeking methods to enhance stability and increase customer lifetime value (CLV). One highly effective approach in achieving these goals is through the introduction of prepaid subscriptions. By offering prepaid subscriptions, brands enable customers to subscribe for an extended duration while receiving a more substantial discount in return.

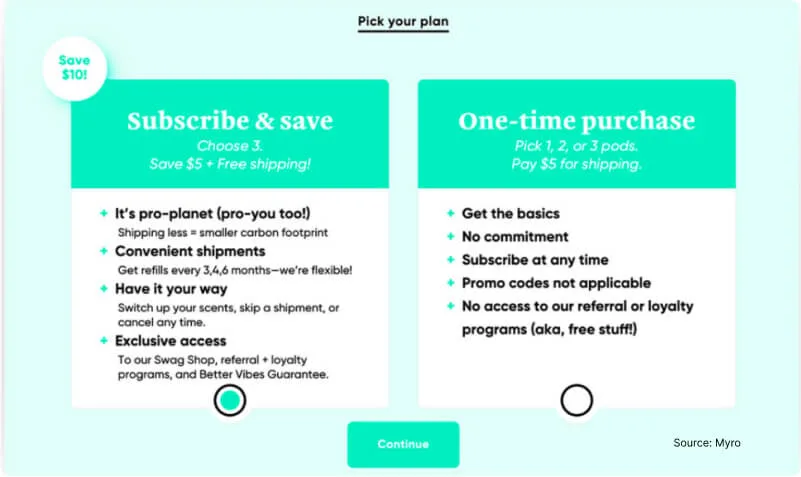

Myro is a company that focuses on creating eco-friendly and sustainable personal care products, with a particular emphasis on deodorants. They are dedicated to reducing plastic waste and offer innovative solutions for customers to make more environmentally conscious choices.

Myro provides customers with the flexibility to choose between a one-time purchase or a prepaid and save option. Opting for the subscription plan not only enables customers to save $5 but also grants them free shipping. To further ease the checkout process, Myro casually reminds customers that they have the freedom to cancel anytime or skip a shipment. Additionally, a clever aspect of Myro’s approach is allowing customers to select three different scents for their initial shipment, adding a personalized touch to their experience.

4. Incentives for Customer Referrals

By leveraging referrals, you can significantly reduce your customer acquisition costs. When a happy customer recommends your product to his near and dear ones purely out of brand satisfaction, such advocacy comes at no cost to you. Even implementing an active referral program, which incentivizes customers to refer others, incurs lower expenses compared to implementing an extensive advertising strategy based on demographic targeting.

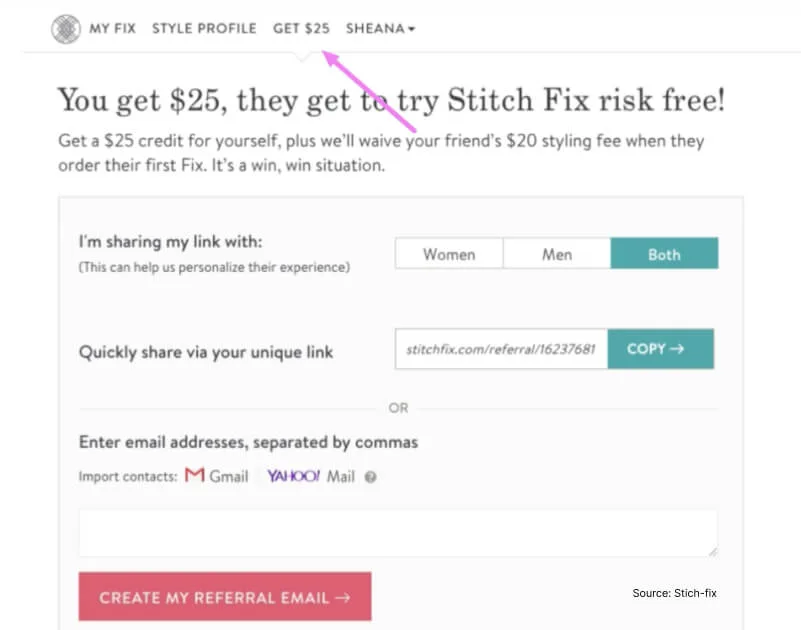

Let me give you an example of Stitch Fix. It is a personalized styling subscription service that caters to both women and men. With a focus on individual style preferences, Stitch Fix collaborates with professional stylists to curate a selection of clothing and accessories that are then conveniently delivered directly to customers’ homes.

Every Stitch Fix customer receives a unique personal referral link that can be easily shared through various channels such as text, email, or social media. When someone clicks on the referral link and successfully completes the checkout process, the person who referred them is rewarded with a credit that is added to their Stitch Fix account.

5. Reorder Capabilities to Streamline the Process

Imagine being able to proactively motivate your customers to reorder precisely when their needs are at their peak. For products that have been used for a long, a straightforward text or email reminder can have a significant impact.

By employing such a strategy, you can effectively minimize your costs and increase customer engagement. When your system can identify the optimal moments for reaching out, you can optimize your customer retention expenditure. This, in turn, enhances your customer lifetime value while reducing the emphasis on customer acquisition costs (CAC).

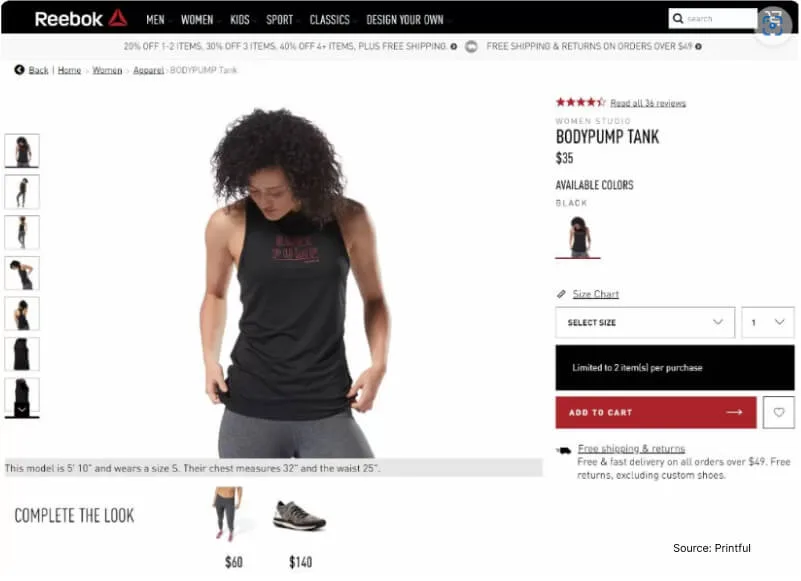

6. Upsell and Cross-Sell

Utilizing the customer information you have gathered, one of the most effective methods to enhance the customer lifetime value (CLV) is through upselling and cross-selling techniques. By leveraging this data, you can identify opportunities to offer customers additional products or services that align with their preferences and needs, thereby maximizing their overall value to your business.

Dedicated customers who have an established order history provide valuable insights that enable you to make recommendations for higher-priced products, especially if they are gradually upgrading their purchases, or suggest items that complement their recent or frequent orders.

On the other hand, for new customers, upselling and cross-selling can be driven by analyzing their browsing behavior using cookies, allowing you to make relevant product recommendations tailored to their interests.

At its essence, this approach takes personalization to the next level while adhering to the same fundamental principle: providing supplementary items that complement the product your user is on the verge of purchasing.

For instance, suppose you decide to purchase a mattress from IKEA. As soon as you add it to your cart, you will likely be presented with a diverse array of associated products. Through IKEA’s sophisticated algorithms, you will receive tailored recommendations for items that perfectly complement the specific mattress model you have chosen, such as bedsheets, mattress protectors, bed frames, and more.

7. Fix a Minimum Order Amount for Free Shipping

Similar to cross-selling and upselling techniques, implementing a free shipping threshold has the potential to boost the average order value (AOV). By setting a minimum dollar amount for free shipping, customers are motivated to add more items to their shopping carts until they reach the qualifying threshold. This strategy incentivizes customers to maximize their purchases, ultimately increasing the overall value of their orders.

Opting for free shipping with a minimum order requirement can be advantageous, provided that the threshold is appropriately aligned with your customer’s average order value. Striking the right balance is crucial – the threshold should be low enough to entice customers to add additional items to their carts, while still high enough to generate a profit for your business.

This presents an opportune moment to employ upselling and cross-selling tactics that effectively persuade buyers to upgrade their orders or include supplementary products. By implementing these strategies, you can further enhance the value of each transaction and increase overall customer satisfaction.

Feels like Reebok has used this technique in the best way possible!

Master Customer Acquisition and Maximize Returns

Ensuring that the cost of acquiring customers does not exceed the value they bring is essential for maintaining a profitable business. If you find that customer acquisition costs are surpassing their worth, it’s crucial to assess your overall marketing spending, business practices, and pricing structures.

Improving customer acquisition costs requires taking a holistic view of your business operations. By comprehending how these calculations contribute to effective business management, you are on the right path to sustaining profitability.

Thank you for taking the time to read this blog. I trust that it has provided you with valuable insights. I would greatly appreciate your feedback, so please feel free to share your thoughts in the comment section below. Stay tuned for more informative topics in the near future. Until then, take care and see you soon!