8 Effective Ways to Improve Customer Experience in Banking

- February 12, 2020

- 15 mins read

- Listen

Table of Content

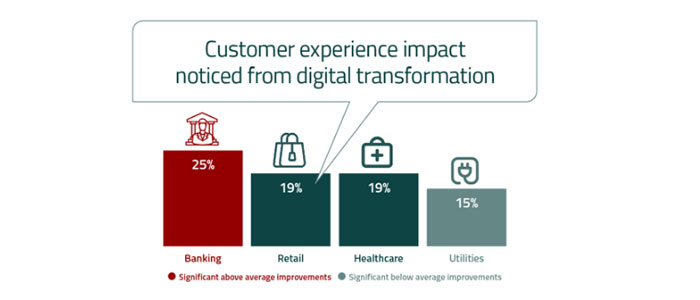

Continuously evolving landscape, cutting-edge competition, and rising customer expectations have become a general thumb rule to adapt to in almost every industry including banking & financial institutions. This is why many insurance banking service providers must keep up with effective ways to improve their customer experience.

The customer experience (CX) in banking is an important aspect of every strategic approach to meet the demands of their customers. Banks and financial institutions need to be digitally transformed to deliver a consistent banking experience whether it is online or retail.

Digital banking allows personalization at the scale that drives between 5 and 15% revenue growth for companies in the financial services sectors.

Banks functioning digitally have witnessed reduced costs and streamlined processes. This end-to-end integration also helps provide an engaging customer experience in financial services and allows business transformation with Artificial Intelligence (AI).

What is Customer Experience (CX) in Banking?

The customer experience (CX) in banking refers to all the efforts you put into making every client feel important when they are interacting with your bank. It is also the cumulation of all the interactions that a customer perceives along the entire journey.

Digital Banking Report has found that “improving the customer experience in banking” should be the first goal for banking institutions and financial service providers.

Banks that invest in the customer experience trends have higher rates of recommendation, greater wallet share, and are more likely to up-sell or cross-sell products and services to existing customers.

The customer experience (CX) in financial services

Delivering an excellent customer experience is crucial for the financial services industry. Poor service & financial advice emerged as the top reasons why people leave their banks and credit unions. Addressing poor customer experience could be much more impactful in the long term. Banks should adopt effective strategies to revamp the banking & financial services experience.

What are the Customer Expectations for the Digital Banking Experience?

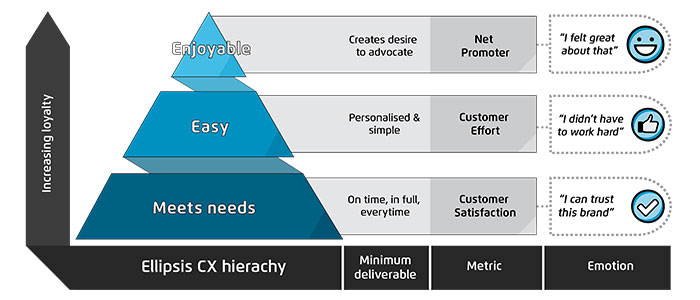

CX has reached a level of paramount importance in recent years, and customers no longer view their experiences in an industry silo. They expect that banks should focus on creating an experience culture that nurtures their needs, builds trust, is personalized, and exceeds their expectations.

The key customer expectations when it comes to digitized banking experience are:

- Easy accessibility – Banks and financial institutions need to provide ease to use digital platforms that are simple to access across multiple devices mainly via smartphone. 15% of banking customers were mobile-dominant. Usually, customers look for a wide range of features, a high-quality banking experience, and an easy way to connect directly.

- Real-time assistance – When customers need “real-time” help, they actually mean it. 76% of customers say instant support is key in building loyalty. Banks can provide real-time support by using live assistance tools like co-browsing & video chat and scale their support with chatbots.

- Personalized services – Customers are always behind personalized services and relevance. They look for products and services that match their needs. Banks can identify the key business drivers and deliver personalized support that will help to shape the customer experience in banking.

- Data security – Data security has always been the most important thing in banking and financial services. Customers want to feel secure in sharing all their information and data with the bank. Banks should be able to build trust to withstand a healthy relationship with customers.

8 Ways to Enhance the Digital Customer Experience in Banking

In today’s banking market, customer experience is a rough landscape for financial institutions to navigate with all of the requirements of the digital transformation era. So, what can be done when digital banking CX challenges are escalating every day?

We have tailored eight startegies to implement digital customer experience in banking. Let’s dive in:

1. Proactive engagement for improved financial management

Innovation in data collection, analytics, and channel strategies has enabled financial institutions to diversify means of engaging customers, and building better relationships through real-time assistance.

While helping customers avail opportunities faster than ever and minimizing their risks, banks and financial service providers will be able to provide effective insights instead of sticking with location-based offers.

How proactive customer engagement helps banks?

- Educate customers – With proper customer education, banks can give their customers a better education about the products and services so that they make better financial decisions.

- Notify customers – Banks can notify customers regarding billing, application status or announcements to keep their customers up to date about their transactions.

- Survey – Banks can proactively collect customer feedback to identify and understand the gaps between customers and banks.

2. Offer live assistance

Mapping your banking customer journey is an excellent way to gain a detailed understanding of your customer’s experience. It can help banks:

- To discover common customer complaints

- Gain insights into how you can improve the customer journey

- Identify the touchpoints customers have with your bank

- Know your customer expectations better

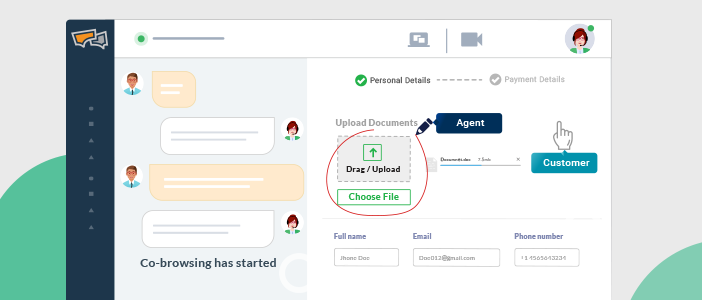

Understanding the banking customer journey mapping, helps banks to provide consistent and excellent customer service no matter what touchpoint your customer uses. Based on customer problems, you can offer live assistance with advanced tools like co-browsing and video chat.

REVE Chat offers a complete suite of visual engagement tools that help to collaborate with customers in real-time and deliver a personalized first response. Sign up today and allow your business to deliver real-time banking support.

By using visual customer engagement, banks can provide faster solutions to their customers in real-time. Bank can also gain additional benefits such as:

- Improve customer resolution time – By collaborating with customers in real-time, bank reps can help to guide customers in the complex banking application process.

- Reduce sales cycle – Having direct interaction with customers helps to identify the problem in a better way and deliver effective solutions at the first contact.

- A number of touchpoints – Live assistance helps to deliver an accurate solution by diagnosing the issue in the first touchpoint.

ICICI bank is a great example of improving customer experience in banking. By using the advanced co-browsing solution, the bank has:

- Simplified the form-filling process that included multiple touchpoints and numerical mistakes.

- The bank has decreased average operating time significantly by 50%, increased customer satisfaction rate by 65%, and the rate of closing contracts by 62%.

3. Use chatbots as your “Financial Concierge”

One of the key aspects that has a direct impact on customer experience is real-time help. Gartner says, “85% of banks and businesses will perform customer engagement with the help of AI chatbots by 2023.”

A chatbot is the best channel banks can use to automate their simple and routine tasks (knowing account balance, outstanding credit card amount, how to change the address, etc.) where human involvement is not needed. You can educate your bots to handle conversations appropriately and match with their language style or convenient time.

When bots are used rightly, they reduce the number of support requests and improve team efficiency.

Here are some potential use cases of chatbots used in the banks:

- Customers today expect faster support and 24×7 availability. Chatbots for financial services can deliver instant support to simpler queries and engage customers around the clock.

- Chatbots in banking give those who prefer self-service a way to talk to their bank as a person and to have a conversation, even when requesting information.

- In-app chatbots can access user account details and provide completely personalized information and help or even financial advice based on data.

Nina, an AI assistant built by Swedbank, is designed to deliver an intuitive, automated experience for all your digital channels by engaging your customers in natural conversations using voice or text. The bank reports of the 40,000 conversations a month that Nina bot handles, resolve 81% of the issues.

4. Prioritize a seamless omnichannel customer experience

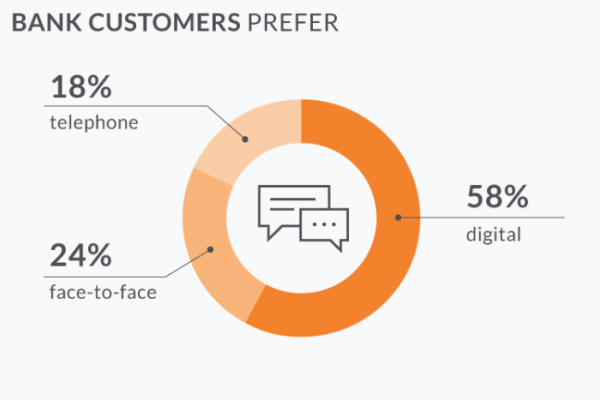

Modern customers prefer to connect with brands across different channels. They can perform the same banking operations, whether they use a website, a mobile app, a call center, a bank’s branch, or any other channel.

Studies show digital channels gain insignificance yearly, but nearly 50% of customers want to have branch services as well.

It means that superior customer service in banking is about delivering the same quality of service across all channels, both online and offline.

Providing omnichannel banking customer experience is about making a similar set of services available to the customers across all the channels, both digital and offline.

The actual omnichannel banking platform also allows real-time data synchronization between different channels. For instance, customers can start the onboarding process with one channel and finish it with another, without the need to provide the same data over and over again.

5. Understand the customer journey

Creating an unrivaled customer experience is an aspiration of today’s banks but how to achieve this? By having an end-to-end customer journey.

It is the roadmap of experiences that customers go through when interacting with your company and brand. It may go on long after customers have signed up for a new account or purchased a product.

Once the journey map has been established, it’s time to determine:

- To what extent is the current customer experience meeting customer expectations?

- Which are the areas of improvement?

- What could be the possible improvements?

Customer needs, motivations, actions, and barriers to action should be considered at each stage of the customer journey. What motivated that persona to perform that action for instance? What would motivate them to move to the next stage of the journey? What obstacles might they face?

Understanding your customer journey in banking is essential to delivering an excellent experience.

6. Make use of big data and analytics

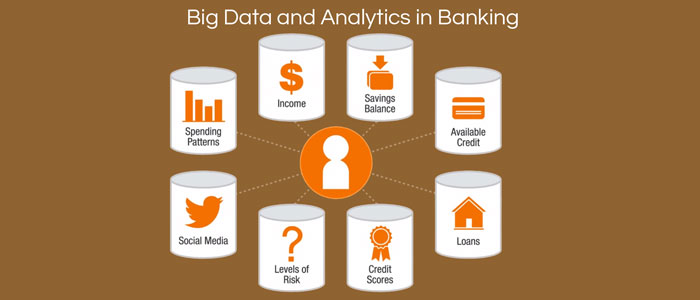

Understanding customers is the foundation for a sustainable competitive advantage in the digital banking experience.

Improving the retail banking experience requires truly understanding your customers and relating to them in ways that they understand. This includes taking a 360-degree view of your banking customer and leveraging the data available.

Big data analytics is a vital ingredient in enhancing financial services experience and making crucial business decisions. The rising fluctuations in customer needs bring in the vitality of leveraging big data analytics to gain deep insights into the same.

With the help of analytics, banks can gain insights to segment customers, evaluate opportunities, and predict models to strengthen engagements and increase the customer experience of digitalized banking services.

One important analytics use case is the experience provided by Personal Financial Management (PFM) solutions. From primitively classifying account transactions into buckets, PFM has come a long way, and current solutions use comparative insights based on consumer history, attitude, and behavior extensively to provide personalized financial advice.

7. Using a personalized CX approach

Personalization is imperative. Everything boils down to delivering value to customers. Understanding customer needs is a vital element for banks to deliver personalized service.

Banks will have to use both physical and virtual channels to deliver banking services as well as financial advice to their customers in the most convenient manner. The approach they need to follow should be a combination of cost-efficient as well as improved banking experience.

The below image shows the impact of personalized services.

Here are some best practices for banks to follow to deliver personalized services:

- Put your customers first – Customer service in banking is the highest priority. It is very important to provide the customers with what they require not the other way around. It is a crucial need to collect customer feedback and act upon the same. By using the right tools and software banks can customize services for their customers.

- Leverage customer data – Banks are supposed to put in the effort to collect and leverage customer data, for understanding customer needs and preferences. This will help in connecting with the right customers and delivering better solutions.

- Deliver multi-channel customer experience – As customers use different channels to do their banking, banks also need to adopt multiple channels while providing personalized services. Apart from their branches, the banks need to customize engagement across other channels like phones, emails, video chat, and messaging apps. Leveraging the use cases of banking chatbots can help a lot to customize customer engagement.

Further, the customer experience provided through these channels needs to be consistent and seamless. In order to achieve this, banks and financial institutions should invest in the IT systems of the latest technology.

8. Transparency, Security, Trust as CX tools

Forbes says, “customers want to feel valued, appreciated, and confident, and 90% of customers who feel valued will advocate for the brand.”

Using the major customer experience tools such as maintaining transparency about your service policies, and terms & conditions, and offering security to the financial details, builds deep trust, and cultivates loyalty in customers.

They move ahead to recommend your products and services to others and they return to you for new services, providing more value to your business.

Key Considerations Why Customer Experience is a Top Priority for Banking

NGDATA’s annual Consumer Banking Survey found that consumers have increasingly high expectations and demand exceptional customer support from banks in exchange for their loyalty. It means that banks and financial institutions must accelerate digital technologies to create good digital transformation examples across their organizations so that they have the tools to become fully customer-centric.

Customers must be at the center of their entire architecture and meet the raised expectations for service providers. Here are some key considerations why retail banking CX is a top priority:

- Consumers want humanized digital interaction – Banks have realized that digital is a fundamentally new challenge for them. It is also a huge opportunity to reimagine the customer experience. By using an advanced banking chatbot, digital interaction can be automated, and at the same time live chat support whenever customers seek it.

- Digital transformation must go beyond cost savings – Banks use advanced customer support tools like chatbots and live chat, and must ensure that they witness an ROI based on the cost. It should not go beyond cost savings.

- Humanized personalization at scale – When it comes to scaling personalized support, it is essential that banks should consider the intangible aspects of customer service such as – customer satisfaction, loyalty, and success, without ignoring the tangible aspects of the course.

The largest bank in India, State Bank of India has launched YONO (You Only Need One), a fully digital banking platform to address customers’ financial and lifestyle requirements. YONO includes a digital bank where customers can do all banking, payments, and other non-financial banking transactions.

Pro Tips to Make Better Banking Customer Experience

Huge shifts in consumers’ expectations are transforming the way people interact with their banking providers. “Performance Against Customer Expectations”(PACE) report highlights a number of key practices that reflect just how quickly the banking industry is changing.

Here are five key components for customer engagement in banking:

Enhance the mobility of products & services

FIS Consumer Banking Report says, “72% of all bank interactions are digital”. People are banking on their mobile devices more than they use any other retail delivery channel, including desktop PCs, ATMs, or physical branches. A poorly performing mobile application is just enough to turn off potential new customers, something no bank can afford. It is time to focus on the improvement of the mobile application data to stay in the race.

Be a financial advisor throughout your customer journey

Customers seeking financial advice land on the sites and end up getting confused about how to use the comprehensive instructions practically. Banks can make the best use of such opportunities to improve the financial services customer experience. With the help of CRM technology, you can collect and analyze data to create customer profiles that can help financial experts get an end-to-end view of customer queries.

The mirror customer experience of brick & mortar branches to Internet banking

Nowadays, customers rarely visit physical branches but it does not mean that it should be ignored. To match the competition of internet banking and boost customer experience it is essential that the brick & mortar serves a similar way as internet banking. Physical banks have capitalized on the value where customers can seek consultative services and learn to use technology. Keeping simple – customers doing Internet banking should avail of similar functionalities, self-service options, and advanced technology so that they have a hyper-personalized banking experience.

Leverage Artificial Intelligence (AI) to automate routine tasks

Long hold time for getting the query answered is one of the frustrating scenarios for customers. AI-enabled chatbots are the perfect way to overcome this customer service challenge in the banking sector. Bots can engage customers 24×7 in a conversation way to answer FAQs. This improves response time and reduces the number of support requests.

Emma from OCBC is a good example of a trend that sees banks turning boys into helpful acquisition and lead-generation engines. The Emma bot is built for home and renovation loans and guides customers and prospects via a conversational approach. It collects the user details and forwards them to the mortgage expert to offer a personalized customer experience. Apart from this, AI is being used for conversational banking to deliver a better experience.

Closing the Customer Experience Gaps in Banking

By understanding the different areas of customer experience, you can come up with an extensive customer engagement strategy to reduce the gaps between customers and your bank. The significance of the digital banking experience can be attributed to its various benefits like reduced operational costs, retaining customers, and staying ahead of competitors by using the latest technologies.

In a nutshell, the customer experience in the banking ecosphere holds massive untapped potential for growth, from meeting the day-to-day needs of consumers and focusing on preparing for disruptive future technologies. Also, signing up with REVE Chat helps to act as a catalyst to deliver a better customer experience in banking.

You can also look over: 9 Most Important Banking Customer Experience Trends